What a beautiful article summing up MF Global as the opening act of "Subprime Collapse II: Sovereign Bonds." Thanks to semper occultus for posting it in the new Schadenfreude thread,

"Gerald Celente Gold Account Emptied By MF Global."

posting.php?mode=quote&f=8&p=435777

As I've been saying, the banking animal could not have acted any differently after all the rewards it received for burning the world, the first time. They have kept running the same model of borrow cheap at enormous leverage to buy high-return junk and sell it to idiots as non-junk while insuring it with default swaps, all the while pretending this can go on forever. The next crash has always been in the coming, and I've called it too many times, but it's so close now that Goldman Morgan et al. this month felt compelled to directly seize power in two European countries, so far. (See chart below.)

Buckle up – Credit Crunch 2

By Golem XIV on November 17, 2011

I am sorry this is such a lengthy article. But I offer it as an explanation and understanding of what is going on that the bankers DO NOT want you to have.

I think it may now be time to buckle up and read that little card that tells you how to assume the crash position.

In a nut shell we are already in the midst of another credit and bank funding crunch. Of course all the talk from the bankers, such as Buiter at Citi and the tin hat brigade at Deutsche Bank is all about how it is all the fault of nations. But it’s not quite so wonderfully simple as that.

Already one multi billion dollar brokerage, MF Global, has collapsed. One Trillion dollar bank, UniCredit, is teetering on the edge of collapse, and two European nations, Italy and Spain, each with enough debt to bring down Europe are desperately trying to borrow euros from the ECB and dollars from the Fed.

Just this morning Spanish bond yields are shooting up well in to unsustainable territory. And French yields are also in motion. Like a train sliding backwards over a precipice, as each carriage goes over so the weight pulling down grows and the weight resisting decreases. And the engine at the front, the ECB/Germany has to think can I still pull all this back up or should I cut the coupling and save myself at least.

There is a crisis and it is in Europe , but the ‘contagion’ is not at all what our cretinous media and brain rotted politicians are telling us it is. The contagion the markets are worried about is bank contagion. Nations’ borrowing woes are the radioactive material, but the banks built the bomb.

Here’s what I mean. What I want to show is that what is happening is almost a carbon copy of what the banks did in the lead up to Credit Crunch 1. They have done the same again only this time with sovereign bonds instead of American mortgages. This is another sub prime and once again it has been engineered by the banks.

To understand why the rise in borrowing costs in Italy and Spain, as well as worries about Greece, have suddenly become a ‘contagion’ that the bankers speak of in apocalyptic terms we have to understand why and how MF Global imploded. This might seem like a sideways diversion but it’s not.

The collapse of MF Global is our window in to what is actually frightening the bankers.

MF Global was not only a huge brokerage it was one of the gilded Primary Dealers. That is, the largest and most trusted banks or brokerages chosen to for their size and stability, to deal everyday with the Fed to help it sell America’s trillions of debt. MF Global was run by Jon Corzine former head of Investment Banking at Goldman Sachs and one time governor of New Jersey. But please don’t get any ideas that there is a revolving door between finance and government.

And yet MF Global collapsed. According to The Guardian it did so because of lax oversight which had not noticed or been bothered by the fact that at the time of its demise,

…MF Global had liabilities at the end of June of $44.4bn against only $1.4bn in equity.

The familiar trope of ‘lax oversight’ goes along with ‘rogue trader’ as the explanation the bankers can live with and are happy for you to accept. ‘Lax oversight’ like ‘rogue trader’ scape-goats one or two people and deflects any questions of whether what happened was a direct consequence of what the banks do and how they chose to do it as a group and profession.

What is undeniable is the massive leverage. Now we need to ask what underpinned this leverage. For that we turn to a report from AP which I picked up at The Business Insider With the Headline, “MF Global Is The First Big US Victim Of The Europe Crisis”. This article began the – It’s a crisis of European nations’ story-line. It begins with the statement,

“The European debt crisis has claimed its first big casualty on Wall Street…”

But how exactly? Much later in the article comes this,

MF had amassed net exposure of $6.29 billion in debt issued by Italy, Spain, Belgium, Portugal and Ireland. Of that, $1.37 billion was from Portugal and Ireland, which already were bailed out by European authorities. More than half was from Italy, whose borrowing costs increased in recent days as investors grew concerned about its finances. (My emphasis)

Now no one had forced MF Global to buy these bonds. MF Global could just as easily have bought German bonds. Only they would have given far less of a return. What MF Global had been doing was buying up dodgy bonds on the secondary market that other people were selling. Picking them up cheap and expecting them to be bailed out.

So now we have massive leverage resting on sub-prime assets, this time bonds not mortgages, which the company had specifically sought out. And it sought them out for the same reasons sub prime mortgages had been sought after – their high risk made them more lucrative than safe ones. Same greed, same idiocy. Same people.

But Corzine wasn’t done yet. Oh no, not by a long way.

MF Global was also following the exact same finding model as Bear Stearns did, as Lehman’s did, as Northern Rock did and as countless others did. They relied for a huge part of their day to day funding on short term borrowing. Why go for short term borrowing which in retrospect seems so unstable – in that as soon as you have a problem you have so little time to sort it before you run out of money? Why, because it’s cheap. Of course. So you buy risky because it’s cheap to buy and offers high return (until it explodes that is) and then you borrow short also because its cheap but unstable. Banking genius at work having ‘learned those lessons’ from 08!

But wait there’s more as explained here by professional accountants in forensic detail. I will give you the short version.

MF Global was borrowing to finance itself but with what collateral? Remember Lehman bothers and their infamous repo 105? For those who don’t, repo is where you ‘sell’ as asset but with a fixed agreement to buy it back at an agreed slightly higher price at a set time. So although it is ‘sold’ it is actually a loan because the asset comes back and the money is returned with interest. All banks use repo for overnight and short term funding.

Lehman’s was using repo but exaggerating the worth of its assets to ‘borrow’ more than they were worth. They came unstuck when creditors would no longer accept their valuations of their assets or, in fact, accept them at all. MF Global was using its dodgy European bonds as collateral. It was marking them to mythic – sorry – model valuations and repo-ing them. But it gets better. The particular type of repo it was using was ‘repo to maturity’. Which simply means the agreement was that the short term repo was to be rolled over and renewed all the way until the bond matured. This is legal. But I should point out the the law was written by the financial firms themselves. The key fact is that repo to maturity is supposed to be done ONLY with absolutely AAA rated bonds like American bonds. MF Global was using it with Italian, Greek and Spanish bonds. Pretending they were AAA even as it was buying them up at prices which recognized they were very far from AAA. And the international accounting standards boards and regulators either didn’t ‘notice’ or did and sanctioned it.

Now what this meant was that MF Global was showing the repo’s as actual sales. Naughty, yes, but terrible? Well, yes. Terrible enough that much of it was hidden off balance sheet. You see by booking them as a sale the company was claiming that the risk associated with them (remember they are dodgy bonds from struggling countries) was also gone. Sold to the ‘buyer’. But there was no buyer. They were only repo’d.

I say ’only’ but in fact MF Global was happy they were only repo’d. It was more lucrative than selling them. And in fact this is in may ways the point of the deal MF was doing. You see the ‘interest’ MF was getting on the bonds, because they were dodgy, was quite high. This was the whole reason for buying them. Whereas the interest charged on short term repo is quite low. So MF Global was buying dodgy bonds which gave high interest and using them to borrow at a lower rate. Not only did this borrowing enable it to leverage itself more and more, but it was even making money on the deal; from the fact that the interest it was getting on the bond was higher than it was paying to borrow, using them as collateral. It seems convoluted and it is. But this is what the bankers call arbitrage and is why they think they are so clever. Understand it and you too could be a proper banker.

However, they ignored one thing. The same thing as Lehman’s ignored. No matter what accounting trickery they got up to, the bonds were not sold they were repo’s which meant that the risk (of the bonds declining in value) remained with MF Global. In fact the risk was now much greater. Not only was there the original risk of the dodgy bonds losing value, they now had an additional, greater risk because they had taken out further loans using the dodgy bonds as collateral. And from the leverage we looked at earlier know just how much MF Global had multiplied the risk.

So when the value of Italy’s and Spain’s bonds began to decline, their value as collateral declined and MF Global was asked to provide additional capital/cash to make up the difference. This is what is called a ‘margin call’. And these margin calls killed MF Global. They couldn’t come up with any more cash because they had none (they’d spent it all buying dodgy bonds) and couldn’t borrow any more because all they had were those bonds whose value was going down not up and a simply insane leverage which geared those losses up till they had the power to crush.

So now we have almost every aspect of the original sub-prime credit crunch reproduced by the same people who did it the first time and were never punished or even rebuked but instead were allowed to reward themselves with millions in bonuses.

So to summarize, MF Global invested in sub prime. Only this time sub prime bonds not mortgages. It leveraged them hideously, pretended it had off-loaded the risk when it hadn’t and then got caught when the value of the bonds went down and counldn’t pay the debts it had taken on using the bonds as collateral. Sorry to belabour the point but I want you to see how this really is subrpime all over again.

And like the original sub prime it means when one bank goes down it leaves all those to whom it owes money, with their own losses.

So now let’s move on from MF Global, because as some wag commented, you never find just one cockroach in a dirty kitchen. Which logic nearly killed a second brokerage, Jeffries. Its stock collapsed on the rumour that it too had bought up lots of European bonds. Jeffries had to take the amazing step of publishing every single position in bonds that it had. Only then did its stock recover.

Since then other banks have been less forthcoming about their exposure, namely Goldman Sachs and JP Morgan. Only they are not so much suspected of having lots of European bonds themselves as having perhaps provided the one part of the whole sub prime crisis we have not so far mentioned, CDS insurance. Goldman and JP Morgan are among the world’s largest derivatives traders. And they revealed that between them they have sold ‘protection’ on over $5 trillion globally. No one knows how much of this is on dodgy European debt and neither Goldman nor JP Morgan is saying.

In sub prime credit crunch 1 it was AIG that provided much of the short term funding and much of the CDS protection. This time who knows who are the main providers. But one thing you can be sure of, there will have been a great deal of it sold. Because it would have been sold using the same logic which inspired MF Global to buy the debt. The logic which said, these are countries too big to fail so in the end they will be bailed out even if democracy has to be suspended to ensure it. If you believed that logic then you wold have sold CDS protection and pocketed the premium.

So that, I believe is all aspects of sub prime accounted for. You can now see that while sovereign bonds and debts may be the fissile material the bomb itself and its explosive potential was constructed by the banks just as they did last time following the same blue-print and same greed.

And how soon might it go off. For that we end with UniCredit. Last quarter the trillion euro bank suddenly posted a ‘surprise’ 10.6 billion euro loss in just this last quarter! It’s bonds are now trading as junk while it faces having to raise another 51 billion euros to re-finance its debt in just the next year. That, to me spells BOOOOM! It is only the first. It certainly won’t be the last. There will be others and they may be along fairly soon.

Why did UniCredit suddenly make such a loss? What was happening during the last quarter? Well Spanish and Italian bonds have lost a lot of value. what do you think, might UniCredit have been holding a lot of them? Surely not I hear you cry. Who would be so stupid. UniCredit blames the loss on its Kazakhstan and Ukraine units. What would those units have been doing to wrack up such monumental losses? UniCredit is now trying desperately to sell bits of itself.

The banks know what is going on. They each know the risks and losses they are hiding and know if they have them then so do the others. Exactly as in Credit crunch1 interbank lending is frozen with both libor and repo markets in disarray.

I suggest these are the real reasons the banks are in an absolute panic and are shrieking about how the ECB MUST print and print now and why elections and voting of any kind at all must NOT be allowed to upset the smooth imposition of the bank’s required plan. There is contagion but it is bank contagion, its sub prime greed and failure all over again.

Source: The Independent

http://www.independent.co.uk/news/busin ... 64091.html

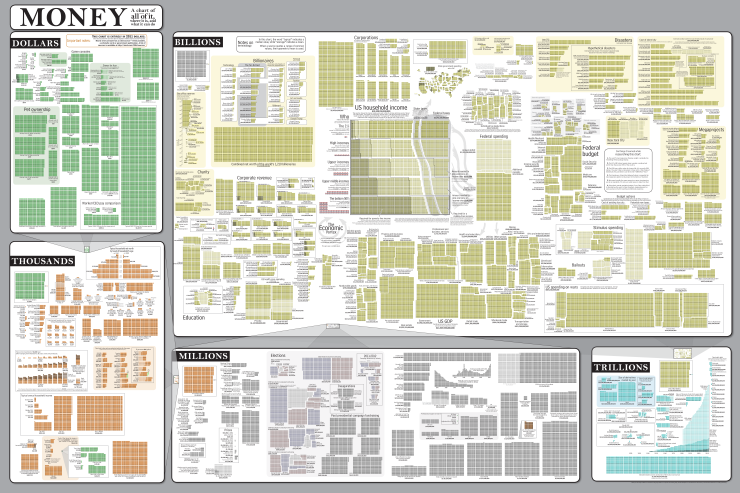

The graphic is from the same article Winston Smith posted above - read it!

What price the new democracy? Goldman Sachs conquers Europe

Stephen Foley

Friday, 18 November 2011

The ascension of Mario Monti to the Italian prime ministership is remarkable for more reasons than it is possible to count....

[/quote]