A Few Recent Highlights

This thread, dating back to Nov. 16, 2008, compiles finds on the financial crash and economic crisis -- how the system works, its history -- and a blow-by-blow as the capitalist mayhem unfolds globally.

To commemorate the 50th page, here are some highlights from the last 20-odd pages, corresponding to the past year. Below, I'm also reposting the index of earlier RI threads on the crisis. (At the end of this post, don't miss the three excellent short-video summaries of how the 2008 crisis happened, assuming you haven't seen them already).

vanlose kid, SLAD, wombat, justdrew and all others who have been active, if you're so inclined, I invite you also to add links to what you feel were the highlights from the whole thread to this page.

Back on Page 1 we began with what was then the best account I knew of the subprime-to-derivatives-to-crash mechanics, and a piece of great writing by

Michael Lewis, "End of the Wall Street Boom"

http://www.portfolio.com/news-markets/n ... rint=true#

Page 44: Richard Heinberg argues the crisis ultimately has an ecological basis (peak oil), while speculative economics exploit and exacerbate an inevitable collapse.

"Temporary recession or the end of growth?"

viewtopic.php?f=8&t=21495&start=645

original http://www.postcarbon.org/article/13059 ... the-end-of

Page 43: Possibly my favorite collection of stuff on one page.

From Krugman vs. Hudson Smackdown on QE2 through another round of deflation vs. inflation vs. hyperinflation to Taibbi on Goldman and much more.

viewtopic.php?f=8&t=21495&start=630

Scenario for an anti-dollar:

viewtopic.php?f=8&t=21495&start=615#p367537

Probably the most indispensable article for understanding the big picture that I have posted here:

"Alternatives to Economic Globalization"

viewtopic.php?f=8&t=21495&start=600#p366222

Prior to the election in 2008, "recovering trade attorney" Lori Wallach lectured at Iowa State University and outlined what I will coin as the True World Order (The TWO!) of the IMF, WTO, World Bank, NAFTA and other globalization authorities. (No satanic magic required, just capitalism.) Since the crises of the 1970s the transnational corporations and financial capital have commandeered the offices of the powerful states led by the US to impose, through obscure and voluminous "trade agreements" mostly unrelated to trade, a neoliberal policy wish-list on almost all of the world's countries. The system intensifies labor exploitation and suppression, overturns national legal codes, accelerates and practically requires all the familiar economic and ecological disasters, and reduces nations to little more than servile bidders for capital. The point is not only to maximize profit but in effect to require states to guarantee and insure it. In just one hour Wallach reviews the history, structure of the system, global impacts, many typical cases of WTO and NAFTA rulings, and examples of successful resistance. (I was pleased to recall the protests that stopped MAI back in the 1990s.)

The video aired on Iowa PBS in Dec. 2008. I found a transcript in a single block-paragraph, so I edited it to add paragraphs and correct some obvious mistakes.

Full transcript:

viewtopic.php?f=8&t=21495&start=600#p366222

Unfortunately it doesn't contain the slides and I don't feel like capturing them off the video.

So watch.

http://www.iptv.org/video/detail.cfm/31 ... 081220_155

Michael Hudson wrote:

!!!

"Table 7.11 of the National Income and Product Accounts (NIPA) reports that total monetary interest paid in the U.S. economy amounted to $3,240 billion in 2009."

!!!

Mortgage Paper - They Did This On Purpose:

STIGLITZ: We Have To Throw Bankers In Jail Or The Economy Won't Recover

David Harvey: The Enigma of Capital and the Crisis This Time

viewtopic.php?f=8&t=21495&start=540#p355531

Big Picture: US Interest Rates, FF, postwar

"The Best Place in History (for this Commission) Would be No Place At All."

Galbraith suicide-bombs the Catfood Commission:

viewtopic.php?f=8&t=21495&start=525#p346405

Financial Con of the Decade (explained in steps), Dynasty Trusts, "Aristocracy of the Dead"

viewtopic.php?f=8&t=21495&start=525#p348328

A Community Currency Proposal

viewtopic.php?f=8&t=21495&start=510#p345225

A Look at the Goldman-AIG Bustout

viewtopic.php?f=8&t=21495&start=510#p346068

The Script to The International wrote:Calvini: "No, this is not about making profit from weapon sales. It's about control."

Eleanor: "Control the flow of weapons, control the conflict?"

Calvini: "No. No No. The IBBC is a bank. Their objective isn't to control the conflict, it's to control the debt that the conflict produces. You see, the real value of a conflict - the true value - is in the debt that it creates. You control the debt, you control everything. You find this upsetting, yes? But this is the very essence of the banking industry, to make us all, whether we be nations or individuals, slaves to debt."

http://kpfa.org/archive/id/61702

"The Financial Hijacking of America" with author, Ellen Brown

Perhaps I’ve said this several times on this thread about other items, but this really is the best summary of the banking system, the financial crisis and its solution you are going to find in a one-hour format.

Ellen Brown spoke in May at the “Understanding Deep Politics” conference in California, and an edited version of her talk was broadcast this week on Guns and Butter. I looked around for video (she used slides) but that’s not out yet and there may be a $10 charge for it when it arrives. No matter, you don't need the charts to understand what she's saying.

Notes on her lecture here:

viewtopic.php?f=8&t=21495&start=480

And now for a trip into mainstream economics.

http://www.cceia.org/resources/transcripts/0244.html

(Article reproduced here under fair-use provisions, with original link given, solely for non-commercial purposes of archiving, education and discussion.)

I’m posting the following in part because of its compact summaries of the major mainstream economists and their influence to this day.

1) ADAM SMITH: The best results for all will be produced by rational actors pursuing their own interest in a free market. Attempts to interfere in the process will backfire, since central planning cannot account for all factors in the same way as the free market. A free market of profit-seeking private entities in competition will promote efficient division of labor and incentivize “innovation” (always a term that demands definition).

2) KEYNES: Introduced self-reflexivity, as we might call it today. Everyone’s aware of what Smith said, so in speculating what best to do each tries to guess what the market will do, independently of what they think is logical. The market becomes a consciously irrational beast.

3) PIGOU: Introduced the concept of externalities. What matters for a player in market economics is the costs they actually pay for, not the costs that are externalized to nature, the workers, the social sphere, or future generations. E.g., health and environmental costs and obligations pushed off into the future. (Only the state or some other collective mechanism can actually force an accounting of these costs in price, artificially through charges.)

Naturally he leaves out our friend Uncle Karl.

4) MARX: The centrality of class conflict. Actors act according to interest. Imbalance of wealth and power favors the owners of capital, who use their position to exploit the producers much as they can. The state is a tool of capital (nowadays they have merged). Profit is an imperative and the most profitable actors win and push out the rest. Profit rates always run into limits, necessitating more and more losers, monopolies and cartels and ever-greater imbalances, inability to absorb overproduction, perpetual crisis.

Now join me as I read Cassidy for a second time. (You should perhaps in fairness follow the link and read him without my comments.)

How Markets Fail: The Logic of Economic Calamities

John Cassidy , Joanne J. Myers

Continued... full transcript with comments...

viewtopic.php?f=8&t=21495&start=480#p342721

July 2010: The current Harper’s magazine has a story of such importance, about a crime against humanity greater than any other we have discussed on this thread, that I’m going to post a copy here. And I will beg you all to go out and buy the magazine, or better yet, subscribe at harpers.org. ... hundreds of millions of people were unable to afford bread because of yet another bankster perpetual-money-motion scheme that added no value to anything other than their bonuses. It makes the subprime securitization scams look very minor by comparison, except that the subprime scams crashed the rest of the world, with similarly dire consequences in suffering and blood.

FROM HARPER’S MAGAZINE, JULY 2010 $6.99

THE FOOD BUBBLE

How Wall Street Starved Millions and Got Away with It

viewtopic.php?f=8&t=21495&start=480#p342988

Jack Riddler Deconstructs Carmen Reinhart

A second public meeting was held on May 26 of the “National Commission on Fiscal Responsibility,” which is referred to above as the "Kill Social Security Commission" because of its high proportion of members who have long sought to turn the supposed "crisis of entitlements" into the nation’s number one source of panic...

The session started with a genuinely interesting presentation by economist Carmen Reinhart. It was interesting for two reasons. First, because her work with Ken Rogoff attempts a broad, comparative, aggregate analysis of financial crises of different kinds over more than a century’s time. The results are worth a look.

Second, it is interesting because the questions and her responses made clear the limits imposed by ideology and capitalist euphemisms. At times Reinhart appeared not just unwilling but constitutionally unable to state clearly what her own data suggested, insofar as this wasn’t what the panel (or other adherents of mainstream finance beliefs) wanted to hear.

One of the most obvious examples of the euphemistic language is in the contrast between the concept of "financial innovation," which refers to the bankster scams in bubble times that Reinhart and her interlocutors seem freely to accept as the generators of financial crisis; and that of "financial repression," which refers to government policies that roll back "innovation" and regulate what the banksters can do (e.g., limiting how much interest they charge and to what purpose they may lend).

...

Complete transcript of Reinhardt's presentation, with Riddler comments:

viewtopic.php?f=8&t=21495&start=480#p343261

(To create this chart, someone helpfully plugged in the numbers from the table at Federal Reserve, "Flow of Funds Accounts of the United States," Release Z.1, March 2010: Table D3, "Debt Outstanding by Sector" (1978-2009). The full report is at http://www.federalreserve.gov/releases/ ... ent/z1.pdf)

Highly Instructive In A Way No Merely Suspicious Death Can Be

One of the most important underreported and decisive steps in protecting the banksters came with the prosecution by the Justice Department of Bradley Birkenfeld - the whistleblower who single handedly broke open the UBS tax evasion complex (which may bring billions in revenues to the US government).

He's the only person serving time in that case. THIS SENDS A MESSAGE TO ALL OTHER WHISTLEBLOWERS. That's regardless of intent. Why should anyone ever again do what he did?

Continued

viewtopic.php?f=8&t=21495&start=420#p337651

A couple of recent article-equivalents I've written for this thread (like the compulsive maniac I am).

Ratings Agency Launches Renewed Terror Attack, Now On Spain

viewtopic.php?f=8&t=21495&start=465#p339038

My guess: Big US economy crash in December will coincide with release of "Kill Social Security" report

viewtopic.php?f=8&t=21495&start=465#p339334

(This one still applies for the same reasons, but December was too soon. I always do that. The big austerity push is looking more like April.)

JackRiddler wrote:Real change will never happen except by socialism. Start by expropriating the banks.

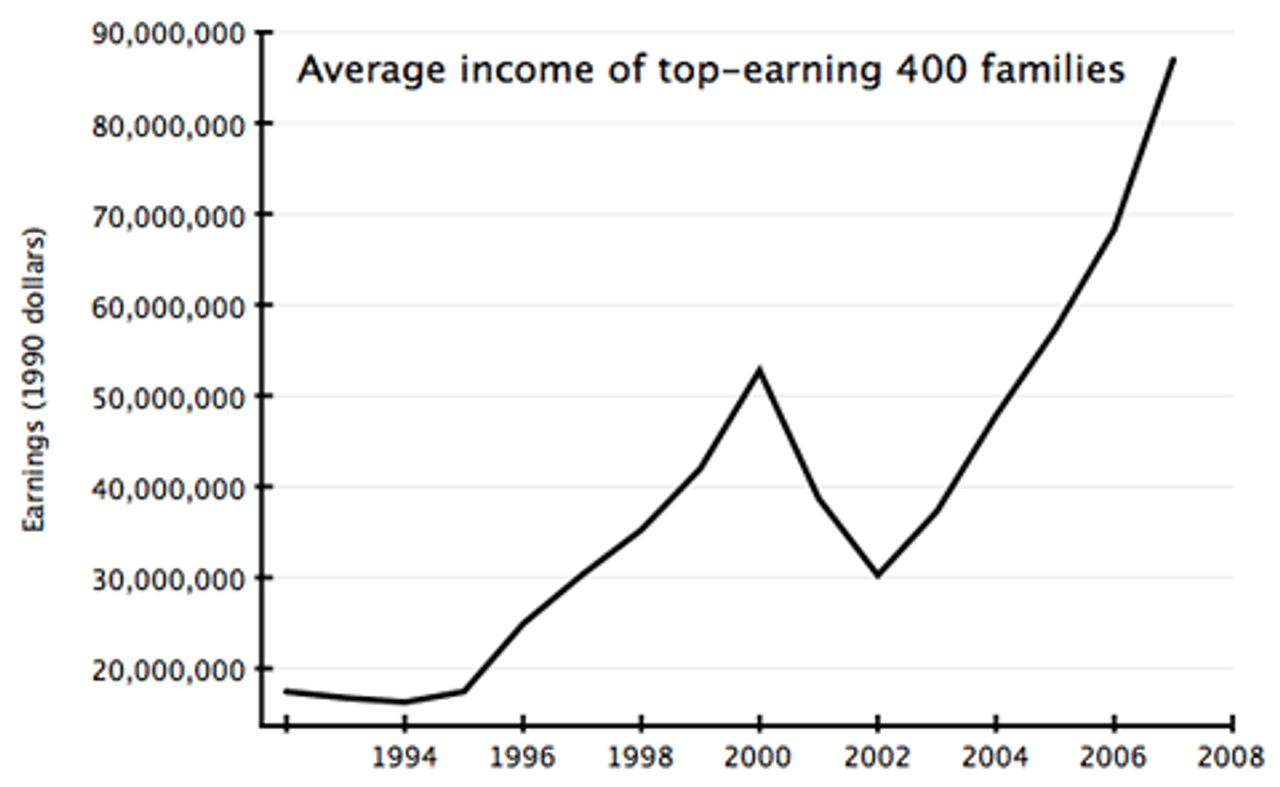

Some news we can all feel good about!!!! The top 400 families are making more than ever!!!!

And the taxes they are paying are at record lows!!!!!!

http://www.democraticunderground.com/di ... id=7775796

It occurred to me while highly informative, these charts on their own may actually cause one to underestimate the wealth and the power of the superrich class!

Continued

viewtopic.php?f=8&t=21495&start=420#p337657

Dean Baker & Michael Hudson

Both Predicted the Subprime Crash in Detail

Baker did so already in 2004 in an article in The Nation. He was right about what was going to happen, and why, and explained why it was obvious and necessary given the policy being followed.

Hudson had a huge cover story in the May 2006 Harper's laying out in the course of 20 highly informative graphics exactly what was about to happen with the housing bubble and mortgage market.

Both stories in full (with graphics) here:

viewtopic.php?f=8&t=21495&start=435#p338004

Simon Schama of Financial Times wrote: Historians will tell you there is often a time-lag between the onset of economic disaster and the accumulation of social fury. In act one, the shock of a crisis initially triggers fearful disorientation; the rush for political saviours; instinctive responses of self-protection, but not the organised mobilisation of outrage…

Act two is trickier. Objectively, economic conditions might be improving, but perceptions are everything and a breathing space gives room for a dangerously alienated public to take stock of the brutal interruption of their rising expectations. What happened to the march of income, the acquisition of property, the truism that the next generation will live better than the last? The full impact of the overthrow of these assumptions sinks in and engenders a sense of grievance that “Someone Else” must have engineered the common misfortune….At the very least, the survival of a crisis demands ensuring that the fiscal pain is equitably distributed. In the France of 1789, the erstwhile nobility became regular citizens, ended their exemption from the land tax, made a show of abolishing their own privileges, turned in jewellery for the public treasury; while the clergy’s immense estates were auctioned for La Nation. It is too much to expect a bonfire of the bling but in 2010 a pragmatic steward of the nation’s economy needs to beware relying unduly on regressive indirect taxes, especially if levied to impress a bond market with which regular folk feel little connection. At the very least, any emergency budget needs to take stock of this raw sense of popular victimisation and deliver a convincing story about the sharing of burdens. To do otherwise is to guarantee that a bad situation gets very ugly, very fast.

And, finally, this whole post deserves repeating:

William Black - Truthtelling Giant

http://fdlaction.firedoglake.com/2010/0 ... ankruptcy/

(Article reproduced here under fair-use provisions, with original link given, solely for non-commercial purposes of archiving, education and discussion.)Bill Black Testimony on Lehman Bankruptcy

By: Jane Hamsher Tuesday April 20, 2010 2:28 pm

FDL Contributor Bill Black scorched everyone with his testimony on the failure of Lehman Brothers before the House Financial Services Committee today.

CHAIRMAN KANJORSKI: And now we’ll hear from Mr. William K. Black, Associate Professor of Economics and Law, the University of Missouri, Kansas City School of Law. Mr. Black.

BILL BLACK: Members of the Committee, thank you.

You asked earlier for a stern regulator, you have one now in front of you. And we need to be blunt. You haven’t heard much bluntness in hours of testimony.

We stopped a nonprime crisis before it became a crisis in 1991 by supervisory actions.

We did it so effectively that people forgot that it even existed, even though it caused several hundred million dollars of losses — but none to the taxpayer. We did it by preemptive litigation, and by supervision. We broke a raging epidemic of accounting control fraud without new legislation in the period of 1984 through 1986.

Legislation would’ve been helpful, we sought legislation, but we didn’t get it. And we were able to stop that because we didn’t simply consider business as usual.

Lehman’s failure is a story in large part of fraud. And it is fraud that begins at the absolute latest in 2001, and that is with their subprime and liars’ loan operations.

Lehman was the leading purveyor of liars’ loans in the world. For most of this decade, studies of liars’ loans show incidence of fraud of 90%. Lehmans sold this to the world, with reps and warranties that there were no such frauds. If you want to know why we have a global crisis, in large part it is before you. But it hasn’t been discussed today, amazingly.

Financial institution leaders are not engaged in risk when they engage in liars’ loans — liars’ loans will cause a failure. They lose money. The only way to make money is to deceive others by selling bad paper, and that will eventually lead to liability and failure as well.

When people cheat you cannot as a regulator continue business as usual. They go into a different category and you must act completely differently as a regulator. What we’ve gotten instead are sad excuses.

The SEC: we’re told they’re only 24 people in their comprehensive program. Who decided how many people there would be in their comprehensive program? Who decided the staffing? The SEC did. To say that we only had 24 people is not to create an excuse — it’s to give an admission of criminal negligence. Except it’s not criminal, because you’re a federal employee.

In the context of the FDIC, Secretary Geithner testified today that this pushed the financial system to the brink of collapse But Chairman Bernanke testified we sent two people to be on site at Lehman. We sent fifty credit people to the largest savings and loan in America. It had 30 billion in assets. We had a whole lot less staff than the Fed does.

We forced out the CEO. We replaced the CEO. We did that not through regulation but because of our leverage as creditors. Now I ask you, who had more leverage as creditors in 2008? The Fed, as compared to the Federal Home Loan Bank of San Francisco, 19 years earlier? Incomprehensible greater leverage in the Fed, and it simply was not used.

Let’s start with the repos. We have known since the Enron in 2001 that this is a common scam, in which every major bank that was approached by Enron agreed to help them deceive creditors and investors by doing these kind of transactions.

And so what happened? There was a proposal in 2004 to stop it. And the regulatory heads — there was an interagency effort — killed it. They came out with something pathetic in 2006, and stalled its implication until 2007, but it ’s meaningless.

We have known for decades that these are frauds. We have known for a decade how to stop them. All of the major regulatory agencies were complicit in that statement, in destroying it. We have a self-fulfilling policy of regulatory failure

because of the leadership in this era.

We have the Fed, the Federal Reserve Bank of New York, finding that this is three card monty. Well what would you do, as a regulator, if you knew that one of the largest enterprises in the world, when the nation is on the brink of economic collapse, is engaged in fraud, three card monty? Would you continue business as usual?

That’s what was done. Oh they met a lot — they say “we only had a nuclear stick.” Sounds like a pretty good stick to use, if you’re on the brink of collapse of the system. But that’s not what the Fed has to do. The Fed is a central bank. Central banks for centuries have gotten rid of the heads of financial institutions. The Bank of England does it with a luncheon. The board of directors are invited. They don’t say “no.” They are sat down.

The head of the Bank of England says “we have lost confidence in the head of your enterprise. We believe Mr. Jones would be an effective replacement. And by 4 o’clock that day, Mr. Jones is running the place. And he has a mandate to clean up all the problems.

Instead, every day that Lehman remained under its leadership, the exposure of the American people to loss grew by hundreds of millions of dollars on average. Auroroa was pumping out up to 30 billion dollars a month in liars’ loans. Losses on those are running roughly 50% to 85 cents on the dollar. It is critical not to do business as usual, to change.

We’ve also heard from Secretary Geithner and Chairman Bernanke — we couldn’t deal with these lenders because we had no authority over them. The Fed had unique authority since 1994 under HOEPA to regulate all mortgage lenders. It finally used it in 2008.

They could’ve stopped Aurora. They could’ve stopped the subprime unit of Lehman that was really a liar’s loan place as well as time went by.

(Kanjorski bangs the gavel)

Thank you very much.

--------

YOU WILL WANT MORE!

90-minute lecture by William Black

https://webdisk.lclark.edu/econ/steinha ... t2010.htmlThis year's Department of Economics sponsored lecture, The Steinhardt, features Dr. William Black, University of Missouri-Kansas City. It occurred Thursday, Feb. 18th, 2010, 7:30-9:00 PM, at the Council Chamber. The title of Dr. Black's talk is: Why Elite Frauds Cause Recurrent, Intensifying Economic, Political and Moral Crises.

---------------------------

---------------------------

---------------------------

... In the Holy Name of Thread Consolidation ...

A Roughly Chronological Index

of (Many) Financial Crisis Threads at RI

& Three Introductory Videos

.

Started By You:

Classic started by antiaristo back during the early months of the crash in Oct. 2007, still continuing at 38 pages:

Federal Reserve losing control

viewtopic.php?t=14190&postdays=0&postorder=asc&start=0

NY Governor Spitzer Linked to Prostitution Ring

Jeff: Mon Mar 10, 2008 -- See RI cooperative research unfold! Rough consensus is that he was taken down by an investigation targeted at him (and never mind that he was at fault) to remove possible threat to finance scam players, for example after his column denouncing them in February... scandal coincided with threat of crash that week averted by $200B Fed cash injection.

viewtopic.php?t=16590&start=0

The Vampire, Struck by Sunlight

chlamor: Fri Sep 19, 2008 -- Simplicity and directness would appear to be advisable, as we are all buried in a torrent of irrelevancies, self-justifications, explanations which explain nothing and serve only to confuse everyone (which is precisely their aim), and an unending stream of lies and half-truths. Perhaps it would be easier to think of it in the following terms, for vampire stories are very popular. The economy of the United States is disintegrating in the same way a vampire does when exposed to sunlight, and for the same reason.

viewtopic.php?t=20406

Now is the Time to Resist Wall Street's Shock Doctrine

American Dream: Wed Sep 24, 2008 -- By Naomi Klein... the dumping of private debt into the public coffers is only stage one of the current shock. The second comes when the debt crisis currently being created by this bailout becomes the excuse to privatize social security, lower corporate taxes and cut spending on the poor. A President McCain would embrace these policies willingly. A President Obama would come under huge pressure from the think tanks and the corporate media to abandon his campaign promises and embrace austerity and "free-market stimulus."

viewtopic.php?t=20498

The Plunge Protection Team

chiggerbit: Sun Sep 28, 2008 -- The article that coined the phrase from the Washington Post of Feb. 23, 1997 and an RI discussion: What is its impact today?

viewtopic.php?t=20547

Why Bail? The Banks Have a Gun Pointed at Their Head and Are Threatening to Pull the Trigger

American Dream: September 29, 2008 -- I've heard lots of phony stories... There is no plausible scenario under which the no bailout scenario gives us a Great Depression. There is a more plausible scenario (but highly unlikely) that the bailout will give us a Great Depression. There is no way that the failure to do a bailout will lead to more than a very brief failure of the financial system. We will not lose our modern system of payments.

viewtopic.php?f=8&t=20578

A primer on the Wall Street meltdown

chlamor: Sat Oct 04, 2008 -- By Walden Bello, Focus on the Global South September 25, 2008 -- The Wall Street meltdown is not only due to greed and to the lack of government regulation of a hyperactive sector. It stems from the crisis of overproduction that has plagued global capitalism since the mid-seventies.

viewtopic.php?t=20676

Dow gains 800 points in less than one hour...

MacC: Fri Oct 10, 2008 -- after having lost that amount in the course of the day -- interesting case study showing evidence of high-level market manipulation.

viewtopic.php?t=20812

The $55 trillion question

chlamor: Oct 12, 2008 -- The financial crisis has put a spotlight on the obscure world of credit default swaps - which trade in a vast, unregulated market that most people haven't heard of and even fewer understand.

viewtopic.php?t=20852

Wall Street's 'Disaster Capitalism for Dummies'

Ninakat: Thu Oct 23, 2008 -- What's most amazing about this piece is that it appeared in the mainstream media by one of the regulars at MarketWatch.com.

viewtopic.php?t=21033

The One Hundred Items To Disappear Off The Shelves First

MOST USEFUL OF ALL THREADS -- Thanks to anothershamus: Wed Oct 22, 2008 --

viewtopic.php?t=21020

30 'leading edge' indicators of the coming Great Depression 2

whipstitch: Mon Nov 17, 2008 -- Nice blow-by-blow set of headlines, basically.

viewtopic.php?t=21516

The Two Trillion Dollar Black Hole (articles by Pam Martens & Bloomberg...)

American Dream: Thu Nov 13, 2008 -- The Federal Reserve is refusing to identify the recipients of almost $2 trillion of emergency loans from American taxpayers or the troubled assets the central bank is accepting as collateral. Fed Chairman Ben S. Bernanke and Treasury Secretary Henry Paulson said in September they would comply with congressional demands for transparency in a $700 billion bailout of the banking system. Two months later, as the Fed lends far more than that in separate rescue programs that didn't require approval by Congress, Americans have no idea where their money is going or what securities the banks are pledging in return...

viewtopic.php?p=229226

More on same:

http://rigorousintuition.ca/board/viewtopic.php?t=21376

U.S. Pledges Top $7.7 TRILLION to Ease Frozen Credit

brekin: Nov. 24 (Bloomberg) -- The U.S. government is prepared to provide more than $7.76 trillion on behalf of American taxpayers after guaranteeing $306 billion of Citigroup Inc. debt yesterday. The pledges, amounting to half the value of everything produced in the nation last year, are intended to rescue the financial system after the credit markets seized up 15 months ago.

viewtopic.php?t=21625

More on same:

viewtopic.php?t=21619

MADOFF SCHEME.

Byrne: Mon Dec 15, 2008 -- Former chairman of Nasdaq stock exchange arrested. Banks hit worldwide by US 'fraud'

viewtopic.php?t=21938&highlight=madoff

Graphing the economic crisis, notice a trend?

Probably the PRETTIEST, also thanks to anothershamus: Wed Jan 07, 2009 -- Here are some graphs, find some more and post here.

viewtopic.php?t=22279

How many billionaires have to die?

anothershamus: Wed Jan 07, 2009 -- Rash of suicides and accidents hits billionaires.

http://www.rigorousintuition.ca/board2/ ... hp?t=22273

Inflationists vs. Deflationists

ninakat: Mon Jan 19, 2009

viewtopic.php?t=22507

prompted by her long list of competing quotes in this one:

INFLATIONISTS vs. DEFLATIONISTS -- a compendium in progress

viewtopic.php?t=22506

Capitalism's Self-Inflicted Apocalypse (Parenti)

American Dream: Wed Jan 21, 2009

viewtopic.php?t=22538

"Dubai is a giant ponzi scheme"

jingofever: Sun Jan 25, 2009 -- So says "a hot tip from within the international intelligence community":

viewtopic.php?t=22594

C.A. Fitts on "Financial Coup d'Etat"

vigilant: Feb. 02, 2009

viewtopic.php?t=22772

$50 Billion Stolen in Iraq? A 'fraud' bigger than Madoff.

americandream: Feb. 16, 2009 -- Senior US soldiers investigated over missing Iraq reconstruction billions. By Patrick Cockburn in Sulaimaniyah, Northern Iraq

viewtopic.php?t=22927

ALLEN STANFORD

jingofever: Feb. 18, 2009 -- Another ponzi scheme, likely CIA asset/drug money launderer.

viewtopic.php?t=22982

IEA Projections and Peak Oil Politics

viewtopic.php?f=8&t=25812

---------------------------

---------------------------

---------------------------

Past threads started by me:

Dow at 36,000

Sun Jun 29, 2008

viewtopic.php?t=18960

The Terrorists Still at Ground Zero, 7 World Trade Center

Sun Feb 17, 2008 -- Cockburn article on the ratings scammery and global protection rackets run by Moody's, S&P, Fitch, plus discussion...

viewtopic.php?t=16227&highlight=spitzer

Lehman files! BoA buys Lynch! AIG begging Fed!

Sun Sep 14, 2008 -- All right now on CNBC.... the crash is on TODAY and 90 percent aren't really aware of it.

viewtopic.php?t=20309

Now I'm confused. Inflation, deflation or what?

Fri Sep 19, 2008 -- So, the government kind of just nationalized the financial sector, at any rate took on its debt with plenty of room to use its assets as collateral. You'd think that guarantees US government insolvency, foreign flight from T-bills, ultimately monetization of US government obligations, a dollar crash, and thus strong drivers toward hyperinflation. Possibly, commodity pricing in euros to follow. Meanwhile, the shell game with the real money has ended up with the richest few holding it, as expected. They don't want hyperinflation. In the real world, most people will be crushed under debt, unemployment will rise, consumer demand will fall, thus demand for commodities also. Investment in production will decline. Asset prices, such as on real estate, will continue to decline. This points to deflation. (SNIP etc.) So what's going to happen now? Inflation? Deflation?[/quote]

viewtopic.php?p=216868#216868

Why do bailout supporters hate the dollar?

Oct 01, 2008 --Support the bailout (plunder plan) or credit will immediately freeze forever and the world will promptly end and it will be your fault for having desired a crash and a great depression, you'll all be thrown out into the street, etc. etc. ... The scaremongering has gone entirely to the favor of the plunder plan, with warnings that credit markets will collapse overnight, Sonic won't get credit, etc. etc. But the far likelier fear scenario is that the dollar will receive a deathblow thanks to the bailout.

viewtopic.php?f=8&t=20610

Crisis a cover for mob-style "bust-out" by spooks?

Sun Oct 05, 2008 -- Well, the likely answer is: no shit! Anyone remember this item from Business Week more than two years ago? The White House authorized the intelligence czar (Negroponte at the time) discretion to grant secret waivers on all SEC rules for any company. National security apparently requires money laundering and cooked books. That would give incredible advantages to such a company in its dealings on the closed markets of derivatives. Wonder if any of the heavyweights involved in the current crisis are among the beneficiaries, and what impact this may have had? Was this the beginning of plunder operations in advance of the inevitable crash? Can companies who received such waivers still present cooked books as the derivatives now unwind? Will the DNI have the authority to block investigations of criminal behavior by protected financial players?

viewtopic.php?p=220561#220561

History of Crude Oil Price, 1948-2008

Sat Oct 11, 2008

viewtopic.php?t=20836&highlight=oil+dollar

Hudson sums up crisis, plunder & bank takeover of US

Mon Oct 20, 2008 -- Licensed Kleptocracy for Years to Come -- The ABCs of Paulson's Bailout

viewtopic.php?t=20964

Meet Government Sachs

Wed Oct 22, 2008 -- NYT article on who is running the show, and never mind the spin, just check out at all those names from Goldman Sachs. The Treasury, the New York Federal Reserve and the financial crisis management are all run officially by a tight group of old friends from one company at the center of the crisis, and noting this in public now qualifies you as a "conspiracy theorist." The current CEO claims G-S is actually disadvantaged by having G-S people running the government? Incroyable!

viewtopic.php?t=21000

Dollar rising strongly - what does it mean?

Sat Oct 25, 2008 -- In the midst of a world crisis based on a debt-induced meltdown within the US FIRE sector, capital has been moving out of the securities markets but also showing a net movement into the dollar region, which now stands at 1.26 against the euro. The yen has also risen, however. What's going on?

viewtopic.php?t=21073

NYT: JPM to use bailout cash for acquisitions, not loans

Sat Oct 25, 2008 -- NYT reporter Joe Nocera spied in on JPM Chase conference call. Some juicy new details that may surprise no one here, but it's always good to see the inevitable documented when it happens...

viewtopic.php?t=21075

---------------------------

---------------------------

---------------------------

The Crisis - Three Short Intro Videos:

The Crisis of Credit Visualized

http://crisisofcredit.com/

http://video.google.com/videoplay?docid ... 2410693117

(See the actual site, but you can download it at the google link.)

Blow-by-blow pictogram animation summary (nice music) of the mechanics and money flows from 2002-2008. Most important to you media-addicted animals: FUN! Explains leveraging, CDOs, tranches, etc. Best of all is at the end, how the default wave starts and propagates. Guy did it as his graphics thesis, best I've seen for beginners. Rather unpleasant in its brief depiction of the poor "unreliable" families who get the subprime mortgages. Mostly ignores the deregulation that preceded and touched it all off, or the politics, thus too faux-neutral and respectful about motives and scammery. Which is why we have the following:

How Subprime Works in Stick Figures - Powerpoint

http://docs.google.com/TeamPresent?doci ... pauth=true

45 slides, very funny, ends with a big "fuck you" all around.

The Story of Stuff

http://www.storyofstuff.com/

Can also be downloaded at above as .mov, or below as .mp4.

http://video.google.com/videoplay?docid ... 6656656736

I can't recommend enough, because it summarizes the production economy and its relationship to ecology in 20 minutes, and for our purposes underlines the ultimate cause of all contemporary economic crisis: GROWTH IS NOT ETERNAL. You can't have that on the planet, and you only compound the crisis when you try to substitute for economic growth by the miracle of compound interest.

.