Mark K 37 minutes ago

Simple question really... why now? Why ban the 500 note now?

ad iudicium 42 minutes ago

In these days of negative interest rates, the public, the voters, need high value notes to stash somewhere so that they can retain a nil position, not a negative one as deflation rides rough-shod over their life's savings. Mrs. Watanabe was way ahead of you Larry in understanding this economic fact. That is why she does not believe in pontificators like yourself garrulously trotting this nonesense out at cocktail parties, nor does he believe your Japanese political or economic equivalents.

If I was in the Eurozone I would get stashing those EUR200 notes away before the European bank also restricts their circulation. The Germans hold too much of the total outstanding EUR500 notes in circulation for them ever to be called in. They still buy cars with hard cash.

Alfonso IX 49 minutes ago

Now if someone would do something also about the 1000 Swiss franc note...

Opinionated 54 minutes ago

I just read all of the comments. Mr. Summers a very small minority agree with you. I hope the FT forces him to read the comments. Maybe the smugness will dissipate a bit.

Opinionated 1 hour ago

" High denomination currency notes stand out as a case in which the good uses are dwarfed by the bad ones, and that is why they should be eliminated. Britain’s Serious Organised Crime Agency has estimated that, before their availability was curtailed in 2010, more than 90 per cent of demand in the UK for €500 notes came from criminals."

2010 was before NIRP. Before the fear of a wealth tax. Before bail-ins. The future may hold a legitimate reason to hold large amounts of physical cash. There is always some bogus reason given by governments and their mouthpieces for doing something. Bengazi, it was always about the video. Leaving Hamilton on the $10 bill because of the Broadway play. No it was just because it was a stupid idea to take our first Treasury Secretary off the 10.

Take away freedom from all of society to keep the reins on the criminal element? Mr. Summers for those of us who have followed politics and economics for more than 1 cycle, your credibility and objectivity is much diminished.

The Matrix Auditor 1 hour ago

Money / cash is the matrix' system of slavery (a vital part of it). By killing cash (slowly of course) the Predator elite just want even more control. Rather than hord €500 notes I suggest gold.

1

WI Quarterback 2 hours ago

If there ever was anyone who epitomizes the saying "I know he is lying because his lips are moving", it is Larry Summers.

Make no mistake, his only interest is to move along the path of eliminating cash altogether to ensure a death grip on all global economies by central banks. Without cash, theft through mechanisms like NIRP can be efficient and complete. Total surveillance of all transactions complete insider trading knowledge down to every individual. Final, and most desirably, without cash, there could be no person, corporation, nor collective endeavor that may possess or transfer wealth without the permission of central banks to access 'their' chart of accounts.

As said in 'Margin Call', "The word is out. I'm hanging up now."

4

rc whalen 3 hours ago

"And certainly there is no suggestion that eliminating cash would be desirable or is in conceivable prospect." Thanks Larry. You sound like Gillian Tett and Martin Wolf rolled into one.

maljoffre 3 hours ago

For anyone interested in a serious article on the topic:

http://www.usatoday.com/story/opinion/2 ... /81080728/

Paulshk 4 hours ago

Lawrence Summers is plainly unaware that those who buy high value luxury goods in Europe to sell them in Asia always prefer cash because of the high transaction fees and FX margins levied by banks and credit card companies.

If you may make 5% on a parallel trade, then saving 0.5% adds 10% to your net income.

Fairly simple really. And nary a payment to a plumber avoiding tax involved.

It would reduce resistance to using credit and the banking system if international transfers and transactions were not felt by cross border traders to involve unreasonable charges.

Banks also impose charges for larger cash withdrawals, thus provoking the traders into making multiple withdrawals (multiplying the need for teller services), which doesn't reduce costs at all...

2

JBCity 2 hours ago

@Paulshk So keep the notes so some fancy-dan can save a few pounds on a Rolex?

PercyPavilion 4 hours ago

Happy Schuman Day, everyone!

pseudonymHK 4 hours ago

Killing off a high-denom banknote is one thing... but making cash transactions above EUR1,000 illegal is ridiculous.

http://churchousepublishing.com/peters- ... less-cash/

2

Jones 4 hours ago

This is a joke. The only reason they kill the €500 note is because of the negative rates and the lack of confidence in the banking system as a whole. There are many taking cash out of banks and putting it in a safe deposit box. Killing this note makes it more difficult and expensive. The criminal thing is a silly excuse.

12

Meh... 2 hours ago

@Jones Where is the evidence of this happening on large scale? The notion that there is a huge amount of cash withdrawn to avoid negative rates is utter nonsense, as no bank has imposed negative rates on its retail customers.

There is no economic reason for 30% of the value of outstanding stock of banknotes to be in the largest denomination, except activity in the grey and black markets.

Opinionated 59 minutes ago

@Meh... @Jones It will likely happen less if you know you always have the choice. Same reason gun sales spike in the US when restrictions are talked about.

Taxpayer 5 hours ago

The real criminals are the ones who allow the banking system to crash. They dont go to jail...

The ones who go to jail are small time crooks compared to the Central Banks ..

5

Pregel 5 hours ago

Rap stars buy €500 notes for flashing around in videos (back to standard gold chain).

stonebird 6 hours ago

The real criminals use tax "havens" and other similar places (Banks etc) that use electronic input. Not cash.

Then there are many smallish savers who do NOT wish to pay negative interest or have their money taken from them in a "bail-in", who are now being treated as "criminals".

What happens to "civil forfeiture" if the US police won't be able to steal billions from the poor in the future?

11

Chris 6 hours ago

The attack on cash needs to stop.. There is every legitimate need for proper money which can be used for large transactions.

This stuff we're being fed about how only terrorists and paedos need cash is absolutely pathetic.

8

Leftover 6 hours ago

At the other end of the cash scale, those small denomination brown coins should be taken out of circulation. They serve no useful economic purpose. Round everything to nearest 10c or p.

maljoffre 6 hours ago

So now the 200 euro note will become "the criminal's favourite banknote" and will be taken out of circulation which means the 100 euro is next, etc.

We are being ushered into a post democratic age when our civil liberties are continually restricted by the acts of a relative handful of "terrorists" and the protection of privacy that using cash affords evaporated by a ghostly spectre of "criminals." Booh!

16

Meh... 2 hours ago

@maljoffre ...meanwhile most people use cash less and less because quite frankly it is beginning to look like an arcane relic in an increasingly electronic economy. Just look at countries like Sweden where around 20% of payments are made in cash in 2014 (down from nearly 20% four years earlier):

http://www.riksbank.se/Documents/Rappor ... 20_eng.pdf

N.N. 1 hour ago

@Meh... @maljoffre I have speedread the article about Sweden. It does not (i) mention criminality, (ii) whether recent immigrants in Malmö were included in the survey, and (iii) what the problems are with cash.

maljoffre 34 minutes ago

@Meh...

You're right about Sweden. The question there is to what extent this result was driven by the government. The point about cash and privacy is that it should be an option because it permits it. I don't have statistics to hand, but anecdotally I think we will both agree through personal observation that the use of cash is far from any risk of extinction in our societies.

Leftover 6 hours ago

Ban violin cases!

7

Opinionated 58 minutes ago

@Leftover Were going to need a bigger case!

Transfer 6 hours ago

The notes facilitate "capital flight".Yes,but surely this is a good thing?If an economy is mismanaged why make it harder for people to take their money out and put it somewhere safer?

7

zen is space 6 hours ago

Criminals

use mobile phones, planes, cars and houses etc, and so by similar logic and irrespective of other people finding use of them, we should remove them,

seriously!

8

Alfonso IX 41 minutes ago

@zen is space Not to mention toilets. Criminals use toilet a lot. We should ban them. If you have nothing to hide sure you can take a dump in the street in plain light....

1

ceteris paribus 7 hours ago

When I skim through Summers's stuff en route to the comments section, I always wonder if he thinks that people are stupid enough to take him seriously or if he is so stupid and arrogant that he takes himself seriously.

12

Citizen No. 58412235 7 hours ago

No, seriously? The next highest denomination euro note is €200. So our archetypal arms trafficker / money launderer/ human organ trader will now need to stash in his Pulp Fiction briefcase 2.5 pieces of paper instead of just one.

Wow.

I really feel the ECB managed to make life challenging for all those mafiosi out there. Surely in light of this decision they're all now busy redesigning their business models from the ground up.

Come on people, let's get serious.

4

ceteris paribus 7 hours ago

@Citizen No. 58412235 In Tier I (premium) pulp fiction, they use low denomination notes so they are not traceable...

1

Smurf in Kent 7 hours ago

Big Larry doesn't care about criminals, big Larry wants to get rid of cash altogether!

9

Stina Andersson 7 hours ago

99% of economic crime as money laundering and fraud is committed by big banks. It is almost always electronic money at work. As an example Standard Bank shareholders was fined about 1 Billion Dollars during the years Mr Peter Sands was CEO and the bank lost 80% in stock market value because of criminality under his watch. No economic consequences for him self. As long as people as Sands &Co is not put into jail there is no reason to abolish €500 notes. Jail the big criminals first.

The war against cash i a typical example were one group of criminals try to divert interest from their own criminality, by accusing others. Big banks shareholders have been fined $280 Bn last years. Not one senior banker have been jailed. Why ?

I heard Prof Schneider presenting at a seminar in Zürich last year. His findings was very unsubstantial and full of guesswork. Many other were confronting his findings. There was more spin than substance.

Big banks and even Central banks is deeply involved in insider trading, rate rigging and other wholesale economic crime. They have better clean up their own act first. Read this interesting comment by John Dizard.

http://www.ft.com/cms/s/0/7adc2ba8-1370 ... 098f0.html

15

GC33 9 hours ago

These notes were so outdated anyway. Surely, bitcoin is the way to go for the modern criminal.

1

@#(($! 9 hours ago

To assume that a single bank note is going to have any effect upon crime given the many other currency options out there of equivalent convenience - diamonds, bearer bonds, gold etc. - is a little silly.

6

Alfonso IX 38 minutes ago

@@#(($! 1 world: 1000 Swiss frank(900 euros, roughly). Just to start.....

XRayD 9 hours ago

..says someone who helped create and support policies which created the biggest criminals on Wall Street, with "get of jail free cards".

15

Trutheludes 9 hours ago

Sometimes one wonders if it would have been found to be practical and proper to run such huge debts as today if there were no computers and one had to write all the numbers in long hand. Just imagine you would have needed huge canvas rolls on which to write all these figures from one end to the other. Then perhaps it would have made one realize how things were becoming crazy.

People are becoming afraid of a 500 note; just imagine the horror of any sensible person at seeing those fearsome canvas rolls.

Should we not be worrying about bigger bin Ladens of the debt mountains instead?

5

bovine fecal matter resistant 9 hours ago

Citizens of democratic countries have a right to high denomination bank notes to shield their savings in cash from rapacious states that are out of economic answers falling back on negative interest rates as an "incentive" to get savers to go out and spend on a lot of dross that they don't need. Governments should not have this power. The money launderers do less harm to people's liberty and well being than the government under these circumstances.

6

Quietly Waiting 10 hours ago

Professor Summer's dismissal of his opponents as people engaged in "shameless fearmongering" is unfair and inaccurate. There are serious questions that need to be raised in response to his arguments.

First, he assumes that assorted types of money launderers will someone be dissuaded from continued malfeasance if they have to pack more briefcases. Five briefcases stuffed with 100 Euro notes can fit into a trunk as easily as one suitcase loaded with 500 Euro notes. Does Professor Summers really think that people willing to risk lengthy criminal sentences or death at the hands of competitors are going to be deterred by carrying more luggage?

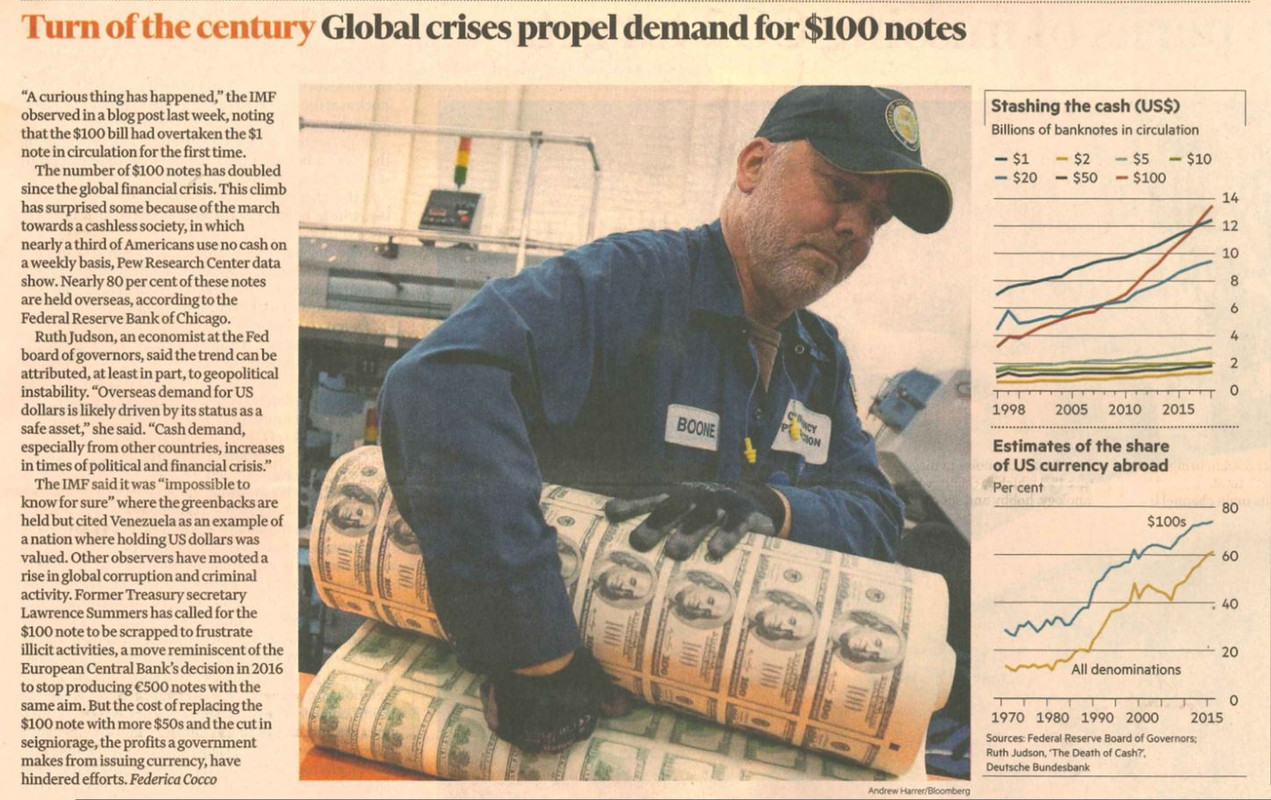

Also, he ignores a very legitimate use of high denomination notes: as a means of avoiding the negative interest rates now imposed in so many nations. For example, he points out that the Swiss 1000 franc note is now the highest denomination in Europe, So anyone wishing to avoid negative interest could place 100 or 500 of these notes in a safety deposit box. If enough people did this, the effects of the negative rate interest policy could be nullified and that is something not either central bankers of the good professor wish to accept.

I hope that the Swiss and the Singaporeans will reject this intimidation.

10

Sasha Verma 10 hours ago

This is again the USA trying to show the word what a good citizen it is. feel good factor that's all that it is. How n the world are you going to eliminate crime by stopping issuing of high currency notes. As regards Switzerland the Americans have succeeded in overthrowing banking secrecy but the sad fact that is often overlooked is that they the USA has states within it who are exempt from banking secrecy requirements. All that has happened is that the money flow is now geared towards USA and so the hegemon becomes even stronger.

In fact if they are serious about crime then they should tackle the drug / currency overlords and no prizes for guessing in which country they predominate. At the click of a finger vast sums of money can be transported over the electronic media - do they really think that we are so dumb and stupid to believe all the claptrap about Euro500 notes and their ability to eliminate serious crime??

Thunk again.

4

J Richard 10 hours ago

An old man talking in the vapors. Who is behind the story? Get rid of crime? The little guys crime but not the 1%. Now the white collar criminals can embezzle and just move the decimal point over. Ban Larry Summers and the hidden agenda instead of the 500 euro banknote.

I don't like being on the sarcastic side but this article hit a sore spot.

12

PaperClip 11 hours ago

Hmmm...removing currencies and adding negative interest rates and we still can't get people to spend more money.

10

Spidey 11 hours ago

It is obviously no coincidence that Summers should celebrate the elimination of physical currency regardless of denomination. The 500 euro is an easy target but just the first of more to come. He will bludgeon us with the argument that "even a small reduction in crime would more than justify the loss of any possible benefit" for every currency amount until there are none. And the economic sovereignty of every citizen is all but completely eliminated.

Men like Summers with contempt for fundamental liberties do not belong in liberal society. He is fit for places like the old communist Soviet Union. Or the kibbutz.

7

Quietly Waiting 10 hours ago

@Spidey

Most of the kibbutzim have become market-oriented and in some case downright capitalist with profit making corporations owned by shareholders. Old style socialism survives only in academia.

xyz 11 hours ago

What a bogus story. How on earth can the criminal world and activities be banned by getting rid of a note? There are special businesses who need large notes such as the used car trade. Banning the large note will make people use more smaller notes, so big deal... Another story from a theoretical person with big titles who has never worked in an all cash business before, go on publish another couple of books about something else please and go and work in a real company for your summer job in 2016 Mr. Summers. it will be an eye opener.

6

sardonic 12 hours ago

>"Cash transactions of more than €3,000 have, in fact, been made illegal in Italy;..."

Reading the linked story, the very first paragraph says:

>"Oct 13 Italy will increase a maximum threshold for cash transactions to 3,000 euros ($3,400) from 1,000 euros in order to boost consumer spending, Prime Minister Matteo Renzi said on Tuesday, raising a cap imposed in 2012 to combat tax evasion."

So, it would seem to be providing a message opposite to whatever Mr Summers is trying to tell us here. The 2015 limit was a 3x increase from what it was before. And the motivation for the increase was to "boost consumer spending" (presumably facilitated with cash?).

And in any case, what does a total cash transaction limit have to do with the maximum cash note size?

8

ceteris paribus 6 hours ago

@sardonic The other impact on Italy is that the cheesy mafia-police shows on TV will have to now shoot scenes where the money is delivered in a humungous wheely trolley full of smaller denomination notes. This will look less cool: just imagine jaw-droppingly handsome, sharp-suited dude with long curly eyelashes, lugging around two or three big suitcases rather than the slim, leather briefcase. The scriptwriters are going to be scratching their heads over this one.

2

Alfonso IX 35 minutes ago

@ceteris paribus @sardonic As any good southern Italian will tell you any transaction in cash is better carried out in medium denomination notes(not too small, not too big), and used.

N.N. 1 hour ago

@sardonic Facts have never stood in the way of a convenient theory.