Moderators: Elvis, DrVolin, Jeff

slimmouse wrote:(Sir) Andrew D. Crockett. Interesting Bio. Any riggies heard of him ? I wont be holding my breath.

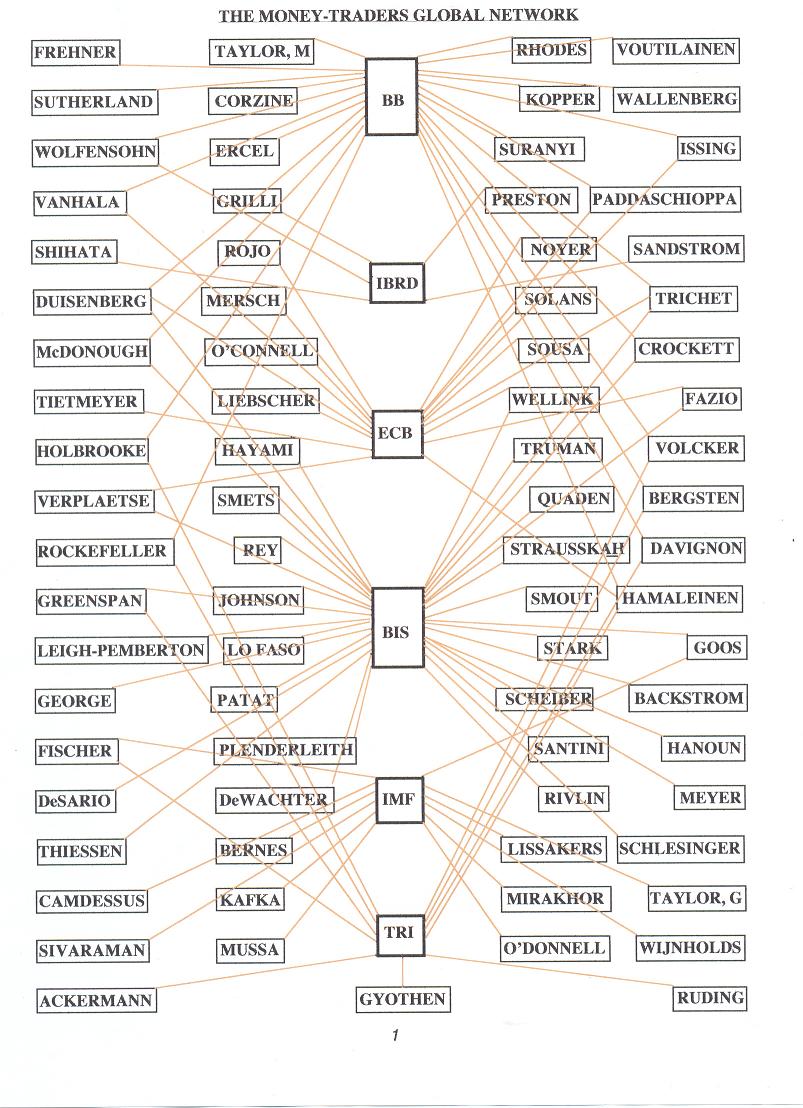

BIS motherlode found

BIS motherlode found

Bank of England helped the Nazis to sell plundered gold

The Bank of England has admitted its role in one of the most controversial episodes in its history - helping the Nazis sell gold plundered from Czechoslovakia months before the outbreak of the Second World War.

By Steve Hawkes

6:37PM BST 30 Jul 2013

http://www.telegraph.co.uk/finance/bank-of-england/10212234/Bank-of-England-helped-the-Nazis-to-sell-plundered-gold.html

An official history, written in 1950 but posted online for the first time on Tuesday, detailed how the "Old Lady" transfered gold held in its vaults to the Germans despite the UK Government of the day placing a freeze on all Czech assets held in London.

In the history, the Bank of England insists its role in the episode was "widely misunderstood", even though it "still rankled for some time".

The Nazis invaded Czechoslovakia in September 1938. In March the following year, the Bank of International Settlements (BIS) asked the Bank of England to switch £5.6m-worth of gold from an account for the Czech national bank to one belonging to the Reichsbank.

Much of the gold - nearly 2,000 gold bars - was then "disposed" of in Belgium, Holland and London. The BIS was chaired at the time by Bank of England director, German Otto Niemeyer.

The UK central bank also sold gold for the Nazis in June 1939, without waiting for approval from Westminster.

The history reveals: "There was a further gold transaction on the 1st June 1939 when there were sales of gold (£440,000) and gold shipments to New York (£420,000) from the No.19 account of the BIS.

"This represented gold which had been shipped to London by the Reichsbank.

"This time, before acting, the Bank of England referred the matter to the Chancellor, who said that he would like the opinion of the law officers of the Crown.

"On the BIS enquiring, however, what was causing delay and saying that inconvenience would be caused because of payments the next day, the Bank of England acted on the instructions referring to the Law Officers, who, however, subsequently upheld their action."

Just three months later the Government declared war on Germany, following its invasion of Poland.

In the official history, the Bank insisted that it would have been "wrong and dangerous" for the future of BIS if Governor Montagu Norman had taken any other course of action. It claimed the UK and French governments would have breached peace treaties if they had blocked the move.

Historians have argued that Montagu Norman supported Germany right up until the Second World War. He reportedly attended the christening of the son of Dr Hjalmar Schacht, president of the Reichsbank before the war.

His right hand man at the Bank was Otto Niemeyer who chaired the Bank of International Settlements which was set up in 1930 as a non-political body to facilitate the payments of reparations from Germany after the First World War.

After the outbreak of war, the documents reveal the Government told the Bank of England it should not act upon an order from the BIS "if it seems to the Bank to be likely that the order might benefit the enemy".

Tower of Basel is the first investigative history of the world’s most secretive global financial institution. Based on extensive archival research in Switzerland, Britain, and the United States, and in-depth interviews with key decision-makers—including Paul Volcker, the former chairman of the US Federal Reserve; Sir Mervyn King, governor of the Bank of England; and former senior Bank for International Settlements managers and officials—Tower of Basel tells the inside story of the Bank for International Settlements (BIS): the central bankers’ own bank.

Created by the governors of the Bank of England and the Reichsbank in 1930, and protected by an international treaty, the BIS and its assets are legally beyond the reach of any government or jurisdiction. The bank is untouchable. Swiss authorities have no jurisdiction over the bank or its premises. The BIS has just 140 customers but made tax-free profits of $1.17 billion in 2011–2012.

Since its creation, the bank has been at the heart of global events but has often gone unnoticed. Under Thomas McKittrick, the bank’s American president from 1940–1946, the BIS was open for business throughout the Second World War. The BIS accepted looted Nazi gold, conducted foreign exchange deals for the Reichsbank, and was used by both the Allies and the Axis powers as a secret contact point to keep the channels of international finance open.

After 1945 the BIS—still behind the scenes—for decades provided the necessary technical and administrative support for the trans-European currency project, from the first attempts to harmonize exchange rates in the late 1940s to the launch of the Euro in 2002. It now stands at the center of efforts to build a new global financial and regulatory architecture, once again proving that it has the power to shape the financial rules of our world. Yet despite its pivotal role in the financial and political history of the last century and during the economic current crisis, the BIS has remained largely unknown—until now.

In the second half, Max talks to precious metals expert, Andrew Maguire, about the run on the bullion banks happening right now.

http://www.maxkeiser.com/2013/07/kr477-keiser-report-no-jail-for-banksters-in-real-world-monopoly/

In the second half, Max talks to Alasdair Macleod of Macleod Finance and Goldmoney about gold backwardation, GOFO and the 1300 tonnes of gold missing from the Bank of England!

http://www.maxkeiser.com/2013/07/kr476-keiser-report-jihadist-safe-haven/

Searcher08 wrote:The original melody was written in the 1920s by the person responsible for the creation of the BIS

http://en.wikipedia.org/wiki/Charles_G._DawesDawes was a self-taught pianist and a composer. His composition, "Melody in A Major" in 1912 became a well-known piano and violin song, and it was played at many official functions as his signature tune. It was transformed into the pop song "It's All in the Game" in 1951 when Carl Sigman added lyrics. Tommy Edwards' recording of "It's All in the Game" was a number one hit on the American Billboard record chart for six weeks in the fall of 1958.[1] Edwards' version of the song also hit number one on the United Kingdom chart that year.[2] Since then, it has since become a pop standard, recorded hundreds of times by artists including Cliff Richard, The Four Tops, Isaac Hayes, Jackie DeShannon, Van Morrison, Nat "King" Cole, Brook Benton, Elton John, Mel Carter, Barry Manilow, and Keith Jarrett. Dawes is the only Vice-President or winner of the Nobel Peace Prize to be credited with a No. 1 pop hit.

9. THE BIS IN BRIEF

From the foregoing profile of the BIS, the following key fields of activity emerge:

* as a forum for international monetary cooperation, the services offered by the BIS in hosting meetings of central bankers and in providing facilities for various committees, both standing and ad hoc, make an important contribution to international monetary cooperation and mutual understanding

* as a bank for central banks, the BIS plays an important role in providing central banks with a broad range of financial services for managing their external reserves

* as a centre for monetary and economic research, the BIS contributes to a better understanding of international financial markets and the interaction of national monetary policies

* acting as Agent or Trustee, the BIS facilitates the implementation of various international financial agreements.

Andrew Crockett General Manager [Bilderberg '98]

André Icard Assistant General Manager

Gunter D. Baer Secretary General, Head of Department

Malcolm Gill Head of the Banking Department

William R. White Economic Adviser, Head of the Monetary and Economic Department

Marten de Boer Manager, Accounting, Budgeting and ECU Clearing

Renato Filosa Manager, Monetary and Economic Department

Mario Giovanoli General Counsel, Manager

Guy Noppen Manager, General Secretariat

Günter Pleines Deputy Head of the Banking Department

The General Manager is Jaime Caruana. The Deputy General Manager is Hervé Hannoun.

The General Manager - the Bank's chief executive officer - carries out the policy determined by the Board of Directors and is responsible to the Board for the management of the Bank.

The heads of the three main departments are Peter Dittus (General Secretariat), Stephen Cecchetti (Monetary and Economic Department) and Peter Zöllner (Banking Department). The General Counsel is Diego Devos.

Other senior officials are Jim Etherington (Deputy Secretary General), the Deputy Head of Banking (vacant) and Josef Tošovský (Chairman, Financial Stability Institute). Claudio Borio and Philip Turner are the Deputy Heads of the Monetary and Economic Department.

Eli Remolona is Chief Representative, Representative Office for Asia and the Pacific, and José Luis Escrivá is Chief Representative, Representative Office for the Americas.

Board of Directors

Last update 1 July 2013

Christian Noyer, Paris (Chairman of the Board of Directors)

Ben S Bernanke, Washington, DC; Mark Carney, London; Agustín Carstens, Mexico City; Luc Coene, Brussels; Andreas Dombret, Frankfurt am Main; Mario Draghi, Frankfurt am Main; William C Dudley, New York; Stefan Ingves, Stockholm; Thomas Jordan, Zurich; Klaas Knot, Amsterdam; Haruhiko Kuroda, Tokyo; Fabio Panetta, Rome; Stephen S Poloz, Ottawa; Baron Guy Quaden, Brussels; Paul Tucker, London; Ignazio Visco, Rome; Jens Weidmann, Frankfurt am Main; Zhou Xiaochuan, Beijing

Alternates

Mathias Dewatripont or Jan Smets, Brussels; Paul Fisher or Michael Cross, London; Anne Le Lorier or Marc-Olivier Strauss-Kahn, Paris; Joachim Nagel or Karlheinz Bischofberger, Frankfurt am Main; Janet L Yellen or Steven B Kamin, Washington, DC; Emerico Zautzik, Rome

lulz

lulzAntonio Maria Costa, head of the UN Office on Drugs and Crime, said he has seen evidence that the proceeds of organised crime were “the only liquid investment capital” available to some banks on the brink of collapse last year. He said that a majority of the $352bn (£216bn) of drugs profits was absorbed into the economic system as a result….

Costa said evidence that illegal money was being absorbed into the financial system was first drawn to his attention by intelligence agencies and prosecutors around 18 months ago. “In many instances, the money from drugs was the only liquid investment capital. In the second half of 2008, liquidity was the banking system’s main problem and hence liquid capital became an important factor,” he said.

Some of the evidence put before his office indicated that gang money was used to save some banks from collapse when lending seized up, he said.

“Inter-bank loans were funded by money that originated from the drugs trade and other illegal activities… There were signs that some banks were rescued that way.” Costa declined to identify countries or banks that may have received any drugs money, saying that would be inappropriate because his office is supposed to address the problem, not apportion blame. But he said the money is now a part of the official system and had been effectively laundered.

“That was the moment [last year] when the system was basically paralysed because of the unwillingness of banks to lend money to one another. The progressive liquidisation to the system and the progressive improvement by some banks of their share values [has meant that] the problem [of illegal money] has become much less serious than it was,” he said…

Gangs are now believed to make most of their profits from the drugs trade and are estimated to be worth £352bn, the UN says. They have traditionally kept proceeds in cash or moved it offshore to hide it from the authorities. It is understood that evidence that drug money has flowed into banks came from officials in Britain, Switzerland, Italy and the US.

Users browsing this forum: No registered users and 5 guests