Just Say No to CBDCsA Central Bank Digital Currency would enable a totalitarian nightmare

N.S. Lyons

15 hr ago

You awake to find that today is special: it’s Stimmie Day! When you roll over and check your phone, you see a notification from your FedWallet app letting you know that another $2,000 in FedCoins has just been added directly to your account by the U.S. Federal Reserve.

To be honest, part of you would love to save that money for the long term, given that things have been getting rather uncertain and actually kind of crazy lately, what with the war and the economy and all… But you can’t, since these FedCoins are coded as usable for consumer purchases only, and will expire and vanish in seven days. So you’d better spend em while you’ve got em!

The latest PlayBox it is then. Everyone says Elden Ring 3 is the hottest VR game on the Metaverse right now, and you’ve really wanted to join in. Since you’re stubbornly old fashioned, you decide to check it out at BezosMart on the way home from work today before you get it delivered by drone to your tiny apartment.

But first you begin your day as you always do, with a quick stop at the local Starbrats’ automated, no-contact drive-through latte dispensary. Opening your FedWallet app and vaguely waving your smartphone at the machine is enough to complete the transaction. $14 in FedCoins are instantly deleted from your digital account at the Fed and recreated in Starbrats’ corporate account, well before the sweet, coffee-flavored milk beverage is deposited into your eager, grasping hands.

Your morning starts to go downhill quickly, however, when you realize that your SUV is almost out of gas. You pull the old clunker, with its antiquated combustion engine, into the nearest open station you can find – it looks pretty run-down – and roll up to the pump. A dull-eyed teenager in a facemask inserts a nozzle into your vehicle and waits for you to pre-pay. You wave your phone at the pump. Nothing happens. You try again. Your phone buzzes, and you look at it. There’s a message from the Fed: “You have already spent more than the $400 maximum weekly limit on fossil fuels specified in the FedWallet User Agreement. Your remaining account balance cannot be used to purchase non-renewable energy resources. Please make an alternative purchase. Have you considered a clean, affordable New Energy Vehicle? Thank you for doing your part to build a more just and sustainable world!”

You have in fact considered purchasing a clean, affordable New Energy Vehicle. But they still aren’t very affordable for you, what with the supply chain shortages. Despite the instant credit the Fed would add to your balance when buying an electric car – plus the permanent ten percent general subsidy you automatically receive on every purchase as a BIPOC individual thanks to the Fed’s Reparations Alternatives for Comprehensive Equity (RACE) program – the down payment on a new car would still be more than you can afford, even with your new stimmie coins.

Well, you’re not going to be able to make it to work at the warehouse on what you have in the tank. How could you be so foolish? You’re going to have no choice but to park here and blow a bunch of money on hailing one of those sleek, incredibly expensive self-driving electric cabs to take you there instead. But, as you’re about to tap the screen to do so, you notice there’s a classic fast-food joint next door. Might as well head there first to unload a little stimmie money. Nothing makes you feel better like a greasy breakfast sandwich.

Entering the establishment and sidling up to the old touchscreen kiosk, you order a McKraken with extra bacon. But when you wave your phone to pay, an error message pops up again. “You have exceeded your weekly purchase limit for complex animal protein, as stipulated in the FedWallet User Agreement. Have you considered purchasing a delicious vegan or mealworm alternative? Thank you for doing your part to build a more just and sustainable world!”

This is a sandwich too far for you during an especially hard week. “Ugh FedWallet is so fucking lame!” you post on Twatter as you idle hungrily in front of the kiosk. “Your message has been flagged for review,” says an immediate notification. “As a reminder, using ableist hate speech may impact your ESG score and future financing opportunities. Thank you for doing your part to build a more just and inclusive world!”

“Omg this is absurd, life was so much better before FedCoin, when we still had cash!” you post again to Twatter, unable to control yourself. “Your account has been locked pending national security review,” says a notification from FedWallet. “As a reminder, the proliferation of false or misleading narratives which sow discord or undermine public trust in government institutions is classified as a potential domestic terrorism offence by the Department of Homeland Security. We value your feedback.”You jerk awake, fumbling at your phone with trembling, sweaty fingers. Oh thank God, it was all just a terrible dream! You just dozed off while reading Rod Dreher’s blog. You can still eat all the steak and bacon you want. There’s nothing to worry about…

But no, you’re actually reading Politico, and see with horror that President Biden has just released a “sweeping” executive order directing the government to immediately begin moving to comprehensively regulate cryptocurrencies while developing a digital dollar issued by the Federal Reserve. “My Administration places the highest urgency on research and development efforts into the potential design and deployment options of a United States CBDC,” he declares, in a line probably narrated in a creepy whisper.

You are wracked by foreboding amid the sudden cawing of ravens.

At least you should be, because everything about central bank digital currency (CBDC) is the stuff of totalitarian nightmare.

But let’s start with the basics:

what is a CBDC?Well, as the term implies, it’s digital money issued directly by a central bank. You might assume that you are already using “digital currency” right now, since you rarely use physical cash anymore, instead buying everything with a credit card or a digital payment app; you impulse buy something on Amazon and these do their thing – with the 1s and the 0s and whatnot – over the internet, and boom: numbers are moved between accounts.

But in truth the process of moving money from A to B is vastly more complicated than that. It involves a tangle of payment processors, banks holding federal debt, financial clearing houses, and, if your money is crossing borders, international communication and exchange systems like the Society for Worldwide Interbank Financial Telecommunication (SWIFT). Since generally the actual money itself doesn’t move, each institution must take on risks to fulfill your transaction by accepting promises, sending transfers, and verifying receipt of funds, etc. So naturally many fees are collected along the way for such services.

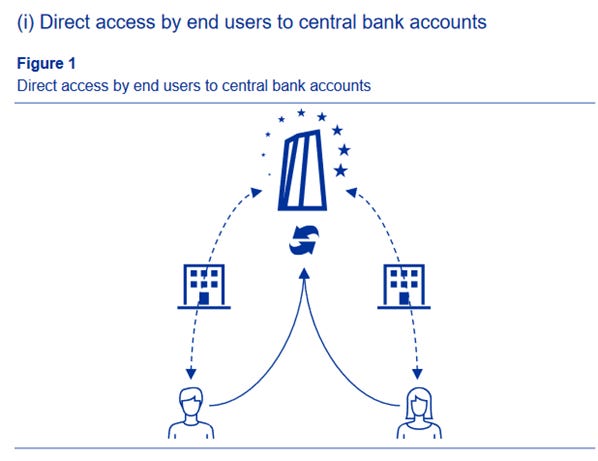

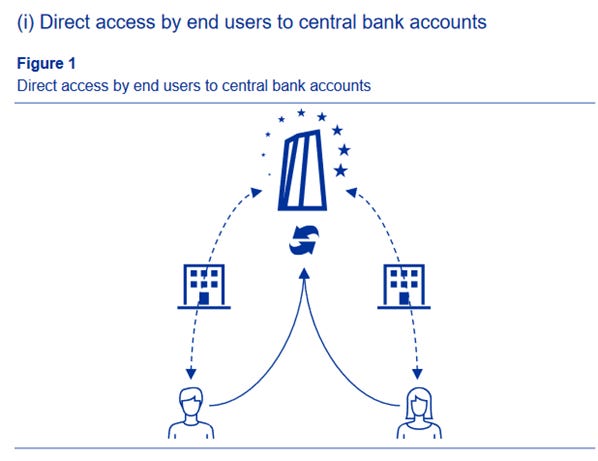

A CBDC system would be radically simplified. A customer opens an account directly with a country’s “independent” central bank (let’s say the Federal Reserve), and the central bank issues (creates) digital money (whether denominated as dollars, or FedCoins, or whatever) in that account. This makes the money a direct liability of the Fed, rather than of a private bank. Using digital tools (like say a “FedWallet” app) the customer can initiate direct transactions between Fed accounts. The digital money is deleted in one account and recreated in another essentially instantaneously. No promises or trust is necessary; every transaction is permanently recorded on a digital cryptographic ledger in real time. Kind of like Bitcoin, but exquisitely centrally managed. The Fed retains complete oversight and control over the creation, destruction, and “movement” of money, no matter who “has” it, or where it “is.”

Or as Agustin Carstens, General Manager of the Bank of International Settlements (BIS), helpfully put it at a 2020 summit of the International Monetary Fund:

“We don’t know who’s using a $100 bill today and we don’t know who’s using a 1,000 peso bill today. The key difference with the CBDC is the central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability, and also we will have the technology to enforce that… and that makes a huge difference.”

Moreover, in such a centralized system there is no longer any need for middlemen like banks or credit card companies. The Fed and its magic coins handle everything. Some planning documents for CBDCs discuss still including private banks in a “public-private partnership” system. But that’s only because customers love banks so much and because banks would love to keep charging fees for handling your money as long as they can, even if in reality they are reduced to being totally redundant husks for central bank software.

Among their many conveniences, CBDCs could also greatly simplify moving money across borders. Something as complex as SWIFT would no longer be needed. If you are moving digital dollars into your investment account from your office in Dubai, that would be as simple as receiving the Fed’s digital blessing. Meanwhile converting dollars into Euros, for example, would be slightly more complex, but just require a pre-existing agreement between the Fed and the European Central Bank to allow this. Of course, if either party did not want you to be able to exchange your money, you’d be out of luck.

Finally, because these digital coins are minted out of code, they are easily “programmable” to function, or not function, however or whenever the central bank wants them to – a small detail about which we’ll get into later.

But first, how did we get here, anyway? Cash has been working at least fairly well for a few thousand years. Why is it suddenly now a matter of “the highest urgency” for the United States to push for a technological revolution in money?

In truth, momentum toward the development of CBDCs has been building for years, ever since Bitcoin appeared and demonstrated that digital currencies were a thing now. Once they caught on, central bankers started doing their own research into how they could best jump on the crypto bandwagon too.

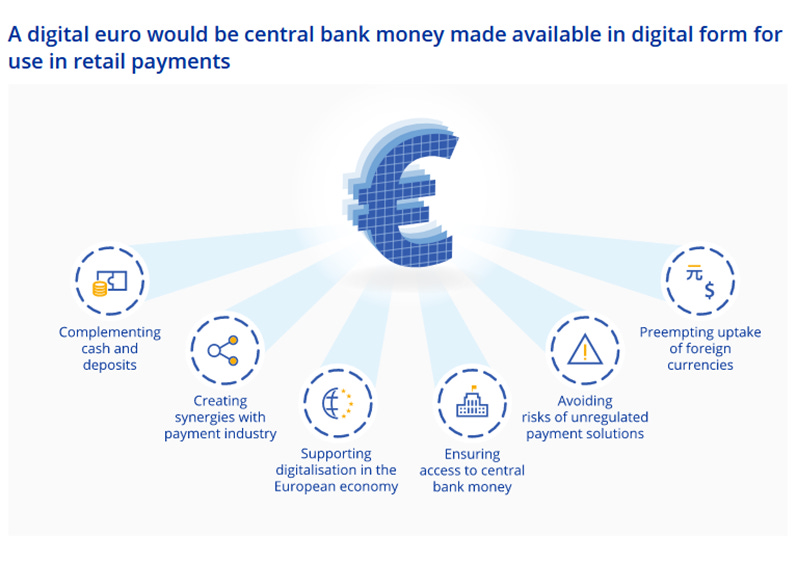

Over the last several years, one central bank after another has released reports on what that might look like. As a summary report by the BIS recently put it, “Central banks' interest in CBDC has increased as a potential means of delivering their public policy objectives,” while allowing them “to evolve in step with the wider digitalisation of people’s day-to-day lives.” Plus, “Profound, ongoing changes across finance, technology and society, as well as the ongoing Covid-19 crisis, provide additional impetus” for doing so now while there seems to be the opportunity for some kind of reset, or something.

And so eight of the largest central banks (including the Federal Reserve, the European Central Bank, the Bank of England, the Bank of Japan, and the Bank of Canada, among others) have decided to form a tentative consortium, with guidance from BIS, in order to “enable interoperability and cross-border transactions between [their] domestic CBDCs” as they move forward with development.

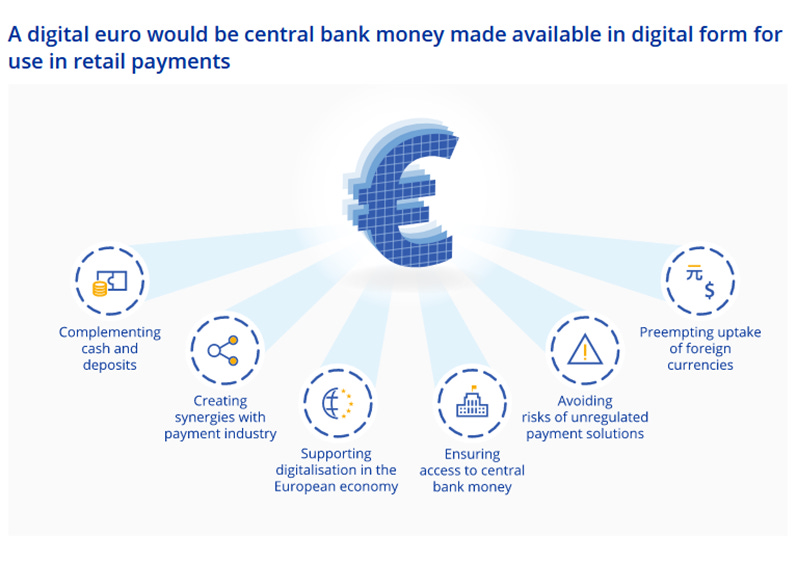

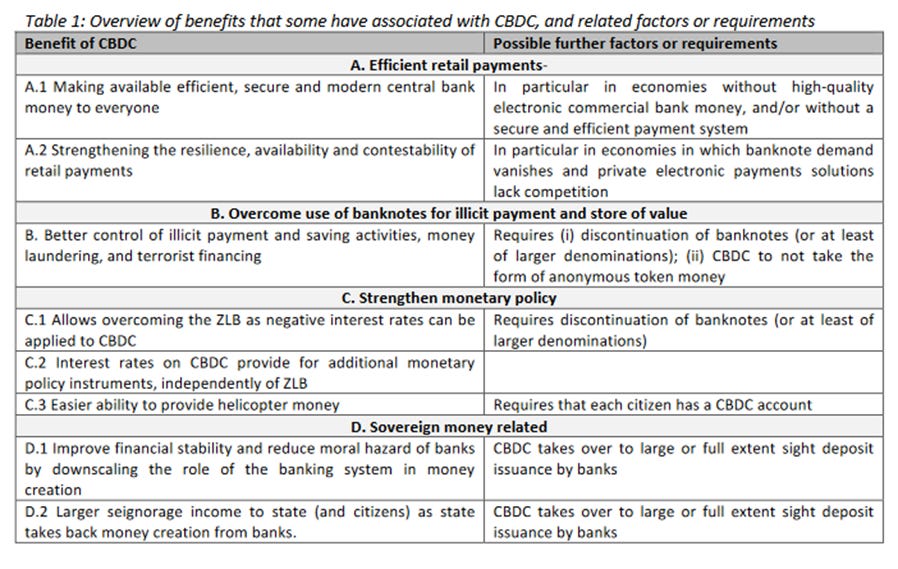

In their public reports, these central banks all tend to cite the same reasons for why implementing a CBDC would be beneficial.

A Fed report from January, for instance, portrays a CBDC as a way to “support faster and cheaper payments,” and “offer the general public broad access to digital money that is free from credit risk.” In particular, it argues that, “Promoting financial inclusion – particularly for economically vulnerable households and communities – is a high priority for the Federal Reserve.”

Biden’s executive order also calls for the need to “Promote Equitable Access to Safe and Affordable Financial Services by affirming the critical need for safe, affordable, and accessible financial services as a U.S. national interest that must inform our approach to digital asset innovation, including disparate impact risk.”

And the ECB figures a digital Euro could not only “increase choice, competition and accessibility with regard to digital payments, supporting financial inclusion,” but also “represent an option for reducing the overall costs and ecological footprint of the monetary and payment systems.”

The Bank of Canada assesses that a “CBDC could be necessary in the future to ensure a competitive digital economy,” and also “solve market failures” on social and economic issues.

“So, under what conditions would a central bank find it necessary to issue a digital currency?” the Bank asks rhetorically. Well, “the answer to the previous question is somewhat trivial: if a CBDC is expected to increase welfare, then a central bank should issue one.” Ah, so simple!

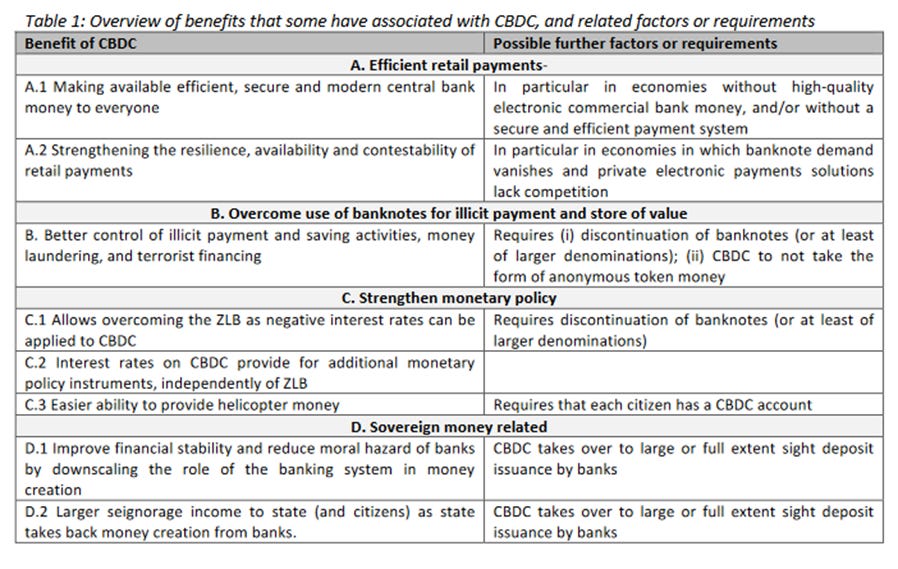

Wait, what was that part about discontinuing banknotes?

Wait, what was that part about discontinuing banknotes?That stuff sounds nice and all, but still: why the new level of urgency? After all, it wasn’t too long ago that Fed Chair Jerome Powell was going around saying that when it came to CBDCs it was “more important to get it right than to be first,” given the “potential risks” and “important trade-offs that have to be thought through carefully.”

Well, fortunately you can always count on the Americans to say the quiet part out loud.

“The United States derives significant economic and national security benefits from the central role that the United States dollar and United States financial institutions and markets play in the global financial system,” Biden’s new executive order states. Therefore, “The United States has an interest in ensuring that it remains at the forefront of responsible development and design of digital assets and the technology that underpins new forms of payments and capital flows in the international financial system.”

Or as BlackRock’s former Global Head of Sustainable Investing, and now Director of the U.S. National Economic Council, Brian Deese put it even more directly:

“The approach outlined in the E.O. will reinforce U.S. leadership in the global financial system and safeguard the long-term efficacy of critical national security tools like sanctions and anti-money laundering frameworks.”Oh, right. You see, it turns out that it’s the Chinese that have pioneered the development of a CBDC (the Digital Yuan) and even begun putting it into limited circulation and testing its cross-border functionality.

Right now the dollar’s overwhelming use by those conducting global commercial transactions means that the United States has quite a bit of leverage to strong-arm banks, or the whole SWIFT network, into not doing business with anyone we don’t want them to do business with – i.e. it can impose sanctions. But if there was some easier, faster, less-interdictable-by-Yankees alternative, something that could move money across borders and be exchanged instantaneously with zero-cost, such as a Digital Yuan, then some people around the world might be tempted to start using that instead of the dollar – in fact many might in time find they have much less use for the dollar at all. In the long-run, only the development of a similarly fast, convenient, convertible, widely used, and easily controlled digital architecture seems certain to allow the West to maintain its collective dominance over global financial flows, preventing the enemies of America and its allies from escaping the long arm of the liberal international order’s sanctions regime.

And by enemies of course I mean Russians. So really it’s hard to see who could oppose CBDCs; I mean, are you pro-Russia or something?

It’s just that,

once we do our patriotic duty and implement a FedCoin to stop Putin, there are some other potential ways in which the Fed may be tempted to use the One Coin of Power here at home that may be worth considering in advance. You see, the unique “programmability” of CBDCs happens to open up a huge range of intriguing possibilities that you, and I, and maybe even the central banks, might not yet have fully thought through.When word first arrived that the People’s Bank of China “has tested expiration dates to encourage users to spend it quickly, for times when the economy needs a jump start,” Western monetary policymakers – who struggled for years to use negative interest rates to stop people from saving – probably spat coffee-flavored milk beverage all over their monitors. But that is still pretty midwit-level creative thinking.

We could of course directly subtract taxes and fees from any account, in real time, with every transaction or paycheck, if we wished. And there would be no more tax evasion, either, since we have a complete record of every transaction made by everyone.

And say goodbye to unapproved money laundering, terrorist financing, or financial crime in general. With a CBDC, all transactions are clean and transparent transactions.

In fact, we could levy fines in real time too, as long as we’ve hooked up the Internet of Things by then – speeding and jaywalking will become the scourges of an uncivilized past!

If we are feeling more generous, there would also no longer be any need to mail out stimulus checks, since money could just be deposited directly into accounts. As could welfare or universal basic income payments – so convenient for the little people!

But why not go higher resolution than that: how about targeted microfinance grants, added straight to the accounts of those people and businesses that are extra deserving? There’s no need to wait for annual tax credits and loopholes when those are now antiquated.

A Fed-funded discount could even be applied to those businesses the people most want to help; Google and Yelp already flag which businesses are or are not black-owned or LGBTQ-friendly, presumably so people can preference their patronage, so why not assist with a little nudge here and there? Or we could go in the other direction and effectively change the price of anything based on the identity of who’s buying it.

Indeed a CBDC could make ending any kind of systemic inequities much easier, and through market friendly means. And as the Federal Reserve Bank of San Francisco has reminded us, after all, being “‘race-neutral’ is not enough” when it comes to monetary and fiscal policy. The central bank could really be doing more in general.

Discriminatory practices like redlining by banks would certainly be a thing of the past; unless of course we wanted to do a little bit of redlining, just to make things a bit more equitable maybe, in which case we could do it, like, super easily.

Prison abolition has proven challenging. But a CBDC could help: just geofence the location within which parolees’ money can be used and not disappear – house arrest will never have been better incentivized! This would also work great in case we wanted to keep people confined to their homes for any other reason.

Should people be incentivized to eat the foods we think it’s best for them to eat? CBDCs can do that. Trying to get people to make reductions in their carbon footprint? CBDCs can help with that too.

But why just focus on individuals? Why not provide preferential financing to companies and investors virtuously meeting environmental, social, and governance (ESG) goals? This can be finely graded based on how closely they conform to standards.

And we could help nudge consumers away from organizations and businesses that are undesirable, too. Why not collect additional fees for transactions with “risky” businesses or charities that have low ESG scores? Or slow down their transaction speed to allow for greater “verification.” Just as a nudge, of course; people would still have free choice.

In fact why not create comprehensive credit scores based on behavior and number of associational connections with dangerous, risky individuals and organizations? It’s only logical as a next step.

Though if it were ever really necessary, like if they were honking truck horns too many times in a row, the most dangerous individuals or organizations could simply have their digital assets temporarily deleted, or their accounts’ ability to transact frozen, with the push of a button, locking them out of the commercial system and greatly mitigating the threat they pose to our democracy – no use of emergency powers to compel cooperation by intermediary financial institutions required!

But that’s just a start. There’s probably no limit to the innovative possibilities, really.

True, making so many interventions could get pretty complex for even a much-enlarged Fed staff to handle, but someday maybe we could plug the whole economy into the black box of a supercomputer AI and let it manage everything for us in minute detail, using perfect surveillance of pricing data to make real-time policy adjustments. Will we be able to comprehend everything that is happening or how judgements are handed down by the algorithm? No, but who cares – do you not already enjoy TikTok? Praise the Fed Spirit, for it will be generous and all-knowing!

Sorry, I got a little carried away there by the bureaucratic thrill of thinking about every remaining mitigating barrier between the private individual and the all-seeing, all-controlling state collapsing into a warm, patriotic plasma of perfect efficiency and social harmony.

It’s just that CBDCs have the potential to be a technocratic central planner’s wet dream. And given the political make-up of the Fed, the direction that dream is likely to take seems to already be pretty firmly fixed.

Meanwhile, in the United States there happens to be no constitutional right enshrining the freedom to conduct property transactions. Which is very convenient for circumventing all those other pesky rights if their bearers happen to stand in the way of the greater good. Freedom of speech? Sure, but it’s not much good if no one can buy those rabble-rousers’ books and they can’t buy ink, let alone web hosting services. Freedom of assembly? Sure, but only if they’re prepared to walk! There’s nothing really in the way of the Fed working to “allow the trustworthy to roam everywhere under heaven, while making it hard for the discredited to take a single step.”

In fact, the implementation of a CBDC could represent the single greatest expansion of totalitarian power in human history. Never has there been any regime with such omnipotent insight into and control over its people’s every transaction as what CBDCs may soon make possible. No Xerxes, no Caligula, no Stalin, no Kim Jong Un has ever held such power. And yet this is what will soon be smuggled into use in our societies in the name of convenience, social justice, and patriotism.

Actually, now that I think about it, maybe we should just say no to CBDCs.