Some call Max Keiser a 'traitor' but America's most outrageous political pundit is about to become the most widely watched newscaster on the planet. Here, he explains why he won't be voting in Tuesday's US election.

Robert Chalmers, The Independent

Sunday 04 November 2012

A serf in the days of King John, Max Keiser argues, was in many ways better off than some US voters in 2012.

A serf in the days of King John, Max Keiser argues, was in many ways better off than some US voters in 2012."Because in the age of Robin Hood," Keiser says, "at least the process of theft was transparent. The barons came to your house. They whacked you over the head then they took all your money." Even if the poor didn't exactly empathise with their oppressors, Keiser adds, they could at least comprehend their methods. "And the serfs," he continues, "did enjoy a modicum of stability. They got something in return for their enslavement. A small plot of land. Shelter. A relationship with the lord of the manor." In the modern age of "financial tyranny" orchestrated by what Keiser refers to as "the banksters" in charge of the major financial institutions in the US and Europe, he believes, "We have reverted to a more pernicious kind of neo-feudalism. The instruments of larceny have changed; that's all."

What better time, you might ask, to have the opportunity to vote in a presidential election? But the real forces which shape the destiny of his homeland, Keiser says, have long been impervious to democratic pressure.

"Barack Obama," he maintains, "has been a huge disappointment. He reneged on every one of his campaign promises except one: he did buy his kids a dog. Of course he could be replaced in this election, but if that happens we will simply inherit a different version of the same thing, just as we have done in the US for the past 30 years. The guy in the White House," he believes, "is really taking his orders from finance."

You may never have heard the name Max Keiser, even though, once he begins to broadcast across China in the New Year, he will have confirmed his status as the most widely watched news commentator on the planet. Assisted by his producer, co-presenter and fiancée Stacy Herbert, Keiser, 52, mercilessly castigates rogue financiers and the politicians notionally required to oversee them, on programmes already transmitted by international networks including France 24, Al Jazeera and Iran's Press TV. No channel in the United States will carry his broadcasts, which go well beyond the benign impudence of The Daily Show.

His most popular outlet is The Keiser Report, on Russia Today (RT), and its international viewing figures, as Keiser (not a man plagued by self-doubt) isn't slow to point out, are huge. What has fascinated me, I tell him, when we meet in his London television studio, is that in Britain, in recent months, I've begun to hear his mischievously seditious RT show mentioned, with admiration, by taxi drivers, patrons in the Haringey Arms, and my window cleaner. This may not, I admit, constitute a statistically significant sample, but Keiser is clearly attracting people you wouldn't necessarily expect to view a rolling news channel on a foreign network.

The presenter isn't surprised. "There is a fury against this global banking fraud that is building every day," he says. "People from all kinds of backgrounds, all over the world, have had enough."

The Keiser Report, first aired in September 2009, is produced here three times a week. One episode, shown in September 2011, contained the interview with Roseanne Barr during which she famously observed that her solution to banking malpractice would be to "bring back the guillotine".

While his sardonic, quick-fire delivery would allow him to shine in a debate at the Oxford Union or a Hampstead dinner party just as effectively as, say, David Dimbleby, Keiser's utterings on the less laudable activities of Morgan Stanley, Goldman Sachs and other financial institutions also manage (unlike Dimbleby's) to resonate with the kind of people who might fantasise about fire-bombing their local branch of NatWest. To illustrate a point, he will occasionally produce a plastic chicken, a stuffed rat, or a small explosive device. On one recent show, he advised David Cameron to, "Go back to Eton and get some of that back-stall shower pleasure."

I tell Keiser how, the first time I saw him presenting the show with Stacy Herbert (his partner's name, somewhat unfortunately, may be familiar from her appearance in 2002 red-top headlines concerning the "three in a bed sex sessions" whose pivot was Angus Deayton), I'd assumed his performance to be fuelled by amphetamines.

I tell Keiser how, the first time I saw him presenting the show with Stacy Herbert (his partner's name, somewhat unfortunately, may be familiar from her appearance in 2002 red-top headlines concerning the "three in a bed sex sessions" whose pivot was Angus Deayton), I'd assumed his performance to be fuelled by amphetamines."I wave my arms," he says. "I shout. Of course I do. Because this is a global insurrection. Against banker occupation."

He folded balloon animals on one show.

"Well, you have to make an impression quickly. Most people first see The Keiser Report at an airport or hotel. RT has 450 million viewers. It goes into more hotel rooms than the BBC and it has more YouTube views. Everywhere I go, people stop me in the street. And remember I'm broadcasting about global financial corruption; not so long ago, everyone used to say, who could be interested in that?"

is histrionic style, combined with the forthright nature of his views (Keiser recently derided the Eurozone as an entity "which poses as this prestigious club, but is actually a leper colony where everyone is checking who still has the most fingers left") have led some to dismiss him as a marginal, whacked-out conspiracy theorist.

This perception is some way removed from the truth. Raised in an affluent New York suburb, Keiser was a highly successful Wall Street stockbroker and the creator and former chief executive of HSX Holdings, a company which, using his own software system, allowed traders to deal in virtual securities. Put simply, this allowed you to gamble on the success – and, more disturbingly to the studios, on the failure – of a Hollywood film before its release. The practice was halted by the industry, but not before Keiser had sold his shares at the top of the market, adding to his already substantial fortune.

He founded the hedge fund Karmabanque, which has sought (with limited success) to profit from any decline in the equity value of companies criticised by environmental groups, such as Coca-Cola and McDonald's. And in 2007, in an Al Jazeera film called Extraordinary Antics, he travelled to Milan to examine how CIA agent Robert Seldon Lady and others had illegally abducted then deported an Egyptian imam, Hassan Mustafa Osama Nasr, who later faced torture in Cairo. (In 2009 Lady, also known as "Mister Bob", was sentenced to eight years in absentia by an Italian court, though the US refuses to extradite him to Italy.)

"I imagine," I tell Keiser, "that some Americans, seeing your work carried by RT, Arabic and Iranian stations, view you as a modern-day Lord Haw-Haw." (William Joyce, the Irish-American who broadcast Nazi propaganda to the UK during the Second World War, and was hanged in London in 1946.)

"Some might. But all around the world, working people love the show. We make The Keiser Report at Associated Press. That, as you know, is an American company. The people who feel challenged are the banksters. What I'm saying is that you can fight back: by fighting fire with fire."

Keiser is among the most outspoken of a group of American commentators (Texas-based broadcaster Alex Jones being another) who argue that national sovereignty and democracy in the US and elsewhere have been eroded by the power of global corporations. Keiser maintains that the most effective form of resistance is through individual financial activism. "If the Karmabanque hasn't worked," Keiser says, "it's because there isn't yet a critical mass of people who are prepared to fight back, and who instead prefer to be victims."

The presenter lived in France for a decade, toying with screenplays including one near-miss based on the life of Houdini, which would have starred his close friend Alec Baldwin. (He currently runs a highly successful crowdfunding site, piratemyfilm.com.) Keiser was based in Villefranche-sur-Mer, near Nice, when he met Herbert, who is eight years his junior, in 2003.

Herbert's apparently subordinate role as co-presenter of The Keiser Report, in which her main task is to prompt, and then revel in her partner's hyperbole, belies her acute instincts as a producer and editor. Before collaborating with Keiser, Herbert, the daughter of a NYPD officer who died in tragic circumstances when she was six, began her career working with Michael Phillips (who co-produced Taxi Driver and The Sting). She was later associate producer on the acclaimed but highly controversial animated 2005 series Popetown. A cartoon sitcom featuring the voices of Mackenzie Crook, Ruby Wax, Matt Lucas, Jerry Hall and Ben Miller, it was once described as Father Ted meets South Park. Originally commissioned for BBC Three, Popetown was dropped from its schedule after protests from the Catholic Church, though it is available on DVD.

Herbert and Keiser moved to London a year ago. "Because this is the world capital of banking fraud. Pretty much every financial scandal of the past 20 years has had its main component in London, because it has the least regulated banking environment. This is very important for the US, because America outsources its own fraud to London, just as it outsources its labour to China." The JP Morgan and UBS traders who lost billions, he points out, were both London-based. "And Lehman Brothers went through the UK. As did AIG." (The latter, a multinational insurance corporation, has been troubled by many controversies including its 2008 government bailout, subsequent executive bonus payments estimated at between $165m and $450m – some say more – and charges relating to accounting fraud, settled out of court in 2006.)

Tony Blair, Keiser adds, "was the first prime minister in this country's history who knew that going into Downing Street would act more as a resumé builder than a way of serving the public. He has become fabulously wealthy with the contacts he made as prime minister." Blair, he continues, "personifies the move, in the UK and the US, away from representational democracy and towards control by bankers. It is since New Labour that you have the rise of these incredible scandals: so you have HSBC involved in multimillion-dollar Mexican drug-laundering. [In July of this year, the bank publicly apologised for its "lapses".] And Barclays involved in rigging Libor [the estimated interest rate for inter-bank loans]."

I tell Keiser I can feel many readers wondering exactly what relevance such activities might have to their lives. "Well, the policy of the banks has been to keep interest rates as low as possible, so as to fuel financial speculation, no matter how oppressive the effect of that would be. Low interest rates wipe out savers and devastate middle-class workers. The banksters have orchestrated this wealth transference of trillions, from the poor to the very wealthy. At the expense of everybody who isn't at the top."

In a recent televised discussion chaired by Andrew Neil, Keiser recalls, "We agreed that the country suffers from economic and financial illiteracy. Which makes it amazing that George Osborne has a programme whereby people will exchange their rights as workers for shares. Why is he proposing this, if not to exploit that knowledge gap? Shouldn't the Chancellor be ashamed of himself?"

"But hang on – you're not an anti-capitalist."

"No. I am pro-capitalism and I am pro-free market. But what you have now is not capitalism. It is a state- controlled, command and control, centralised politburo. Both in Britain and the United States. The States is run by the Federal Reserve, an institution that answers only to itself and to a few large banks. It's modelled on the Bank of England. Ben Franklin said that one of the main reasons America revolted was to get away from the Bank of England, the mother of all central banks; the most pernicious and insidious of all."

"You said you were disappointed by Obama. What should he have done?"

"When Franklin D Roosevelt came into office, he started putting bankers in jail. The foremost reason that America got out of the Depression was not World War Two, or because of the Keynesian stimulus. It was because of the legislation introduced to regulate markets [many such clauses in FDR's Emergency Banking Act of 1933 were dismantled under Clinton] and the banksters that Roosevelt sent to jail."

"Don't you think Obama came in with the best of intentions? Surely he's not just another avaricious politician?"

"Barack Obama had to face up to people like Larry Summers [Clinton's former Treasury Secretary, and director of the US National Economic Council until two years ago, Summers had a key role in lifting safeguards in the derivatives market, a move generally considered to have precipitated the 2007/8 crash]. There were others he failed to remove from office, who were guilty of orchestrating this economic collapse."

"Are you accusing Obama of malicious complicity?"

"I think that Obama is, like many people, financially and economically illiterate. He is a lawyer. But in Wall Street there is no law."

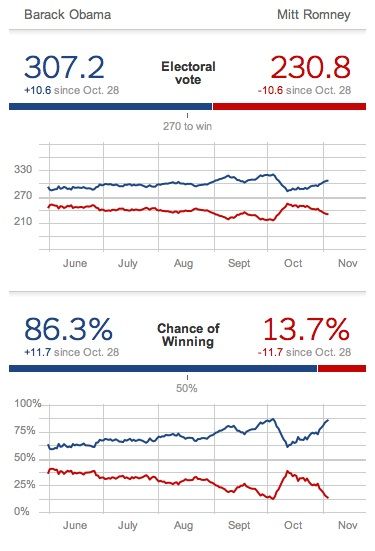

Is the implication that the situation will change if Obama is defeated? "It's not difficult to envision what a Romney presidency would be like. He's already made it clear that he believes Wall Street to be over-regulated, which of course is the opposite of the truth."

Romney's background, Keiser adds, is in private equity, "which is the crystallisation of the worst elements of capitalism". (Private-equity firms tend to specialise in leveraged buyouts: a practice whose potential consequences have become familiar to many non-economists in Britain, not least to supporters of Manchester United since the club's purchase by the Glazer family in 2005.) "So then you would have a pure cacistocracy: rule by the worst, the most ignorant, and the most corrupt."

On Mitt Romney's first day in office, Keiser adds, "I would imagine that, rather as Emperor Caligula appointed his horse to the senate, he will issue proclamations and edicts that will shock people. But if he does release the genie of even more deregulation, bankrupting the country, he would do so in the full knowledge of the crime he was committing. I believe that Obama was less consciously aware of the stupidity he was engaged in."

ax Keiser grew up in Westchester County, a New York suburb so steeped in Ivy League privilege that Loudon Wainwright III wrote a song about it ("We were richer than most/ I don't mean to boast/ But I swam in the country club pool"). It's not hard to imagine his robust intelligence being applied in other fields, such as teaching or law. While his name may evoke images of some prosperous chancer in a James Bond film, he doesn't come across as your average money man. So how did he wind up prospering on Wall Street?

"I'd been to New York University," Keiser recalls, "where I studied theatre. That's where I first met Alec Baldwin. I did a lot of radio, and stand-up comedy. I spent my time watching punk and rap bands at CBGB and Max's Kansas City. My biggest fear in 1983 was that the party would end. I'd done various jobs." These included working as a street magician on Broadway.

"Then I got a part-time job at Paine Webber, a brokerage firm on Wall Street, just to support myself. I remember walking in and seeing the brokers all looking up at the ticker tape on the wall. They were in very expensive suits and smoking cigars. I could see that, by this means, the party could continue. So I became a stockbroker. And the party not only continued, but intensified."

"It must have been a bit of a culture shock."

"Not so much as you might imagine, because stockbroking had sort of a punk aesthetic. It was a DIY revolution. I had no background in it whatsoever. But in the early 1980s suddenly there was the start of this bull market: a tsunami of cash was arriving every day on Wall Street. It required no talent whatsoever to make gobsmacking amounts of money. A rhesus monkey could have done it."

"And socially?" "We took the party into the office. We're making calls to customers during the day. At the same time we're getting calls from hookers and drug dealers. I remember I woke up on a plane one day; k I was coming out of a blackout. I asked my buddy, who I'd started the outing with, who knows when, 'Where are we going?' He said, [the Caribbean island of] 'St Thomas.' I don't remember a whole lot after that. Anyhow, we ended up back in the office. Then I heard my friend, shouting: 'Shit… Oh my God, shit…' I asked what happened. He said, 'Max... when we were down there in St Thomas… did I buy a house?' He had done, and he had absolutely no memory of it. After the crash in 1987 the party ended."

"What were people taking: drink and cocaine?"

"Yes. There was cocaine on everyone's desk, more or less. At that time you could take a shoeshine guy – and they did – and with the systems they had, which allowed swift calls, and using sales scripts, he could make hundreds of thousands of dollars in months."

Of the many themes that Keiser returns to in his shows, one of the most interesting and incendiary is the relationship between big business and Congress. He has openly accused senior politicians of using investigations into financial malpractice as a way of acquiring market information so as to benefit themselves.

"Democracy is not well served by the current political configuration in America," he maintains. "The entire political establishment is designed around enriching a minority of people who have access to both information and capital. Take the CIA. They have recently opened up their services to hedge funds. Hedge-fund managers can now hire CIA agents to do research on pharmaceutical companies, defence contractors, or oil contracts."

I can imagine some of his compatriots regarding such talk, especially his accusations of endemic insider trading in Congress, as treasonable. "Treason is a strong word. My family arrived in America in the 1700s and was active in the constitutional process that led to the Declaration of Independence. I would answer that charge by saying, as they do down south, 'That dog don't hunt.'

"Nobody has a greater affinity for the founding principles of America than I do. But what the people with power are doing now is not remotely connected to the ideals of the founding fathers."

Any talk about treason, Keiser argues, would be more suitably aimed in the direction of men such as his principal bête noir, Hank Paulson, a former CEO of Goldman Sachs who served as the US Treasury Secretary from 2006 to 2009. "There is a revolving door for Goldman Sachs guys into and out of US government. And they are working against the sovereign interest of the United States. What's happening is that all these bankers in Europe are consolidating into one major bank that's going to be running Europe, from Brussels. All of that debt will be re-priced in some new European-wide currency. And that bad debt will be joined with all the American bad debt, in some new global reserve bank. And every single step of the way guys like Hank Paulson – who really is a traitor – will put a gun to the head of the American people and say, either you accept this new banking deal or we are going to crash this market."

Among Keiser's fans, Paulson more than anybody has come to personify the culture of greed and flagrant conflict of interest that the broadcaster satirises.

"You don't like Hank Paulson very much, do you?"

"The fact that that man is even breathing and walking… the last time I was on Al Jazeera live," Keiser adds, "was when I declared a fatwa against Hank Paulson."

"Fatwa defined in what way?"

"The word has certain resonances, after the Salman Rushdie affair. That's not what I was saying. Under Bush and Obama, the office of president has acquired enormous power: to pretty much arrest anybody in the world. With no due process. No habeas corpus. If you have the ability to arrest a man on a mere suspicion, and detain them without reference to judge or jury, then that man's name is Hank Paulson. Go after the really bad guys."

Fear, Keiser believes, is what stops such opinions being transmitted in his homeland. "Look at these clowns who present shows. Like [arch-conservatives] Rush Limbaugh and Bill O'Reilly. These people are not Americans. They are the subversives. They are the ones tearing American society apart by belittling everything that, at its heart, could be construed as the lifeblood of democracy.

"Those guys," Keiser adds, warming to his subject, "are shameless. They are despicable. My merely pointing out where crimes are being committed is not treason against the country. It is an act in support of reform to get the country back from the clutches of these foreign bankers."

"So who would you like to see elected?" "The only politician that I like is [former independent presidential candidate] Ralph Nader. Because he talks about corporations. And corpocracy. He isn't running. So I won't be voting."

Listening to Keiser, I tell him, I'm left with feelings of little else but imminent doom. He has few words of comfort. "The global derivatives market, which is a quadrillion or more in size, is a very complicated, highly unstable system which is becoming more unstable with every hour," he says. "It is similar to the side of a mountain before the last snowflake arrives to trigger the avalanche. Or, like Mr Creosote [who explodes at the dinner table in the Monty Python film The Meaning of Life] is just waiting for that final after-dinner mint."

Any hope of recovery, he argues, will come not through the ballot box but financial initiatives on the part of individuals; notably a mass campaign to ignore governmental advice to trust in bonds and paper money – investments in which, Keiser insists, confidence has rightly evaporated.

"People have to take action for themselves. That means buying not bonds or dollars or euros, but gold and silver. Gordon Brown sold Britain's gold at the historic low of $250 an ounce. Gold is now $1,700 an ounce. My argument – I can categorically state – is winning the global propaganda war. China is aggressively buying gold. Russia is buying gold like a maniac. Iran has been buying as much as it can. All of these countries, where my show is popular, are buying gold and silver, and God bless them for it."

Purchasing such commodities, he believes, will offer the owner true security and accelerate the demise of "the banksters", who speculate only in notional wealth, and paper money.

renetic and controversial as he may be, Keiser has a decent record on prediction. He was in Reykjavik, issuing bleak warnings, months before Iceland's catastrophic economic collapse. He was talking about Athens years ago, predicting civil unrest and what now appears to be an inevitable Greek default.

"I came to London," he says, "because being here gives you a front-row seat on the imminent collapse of an entire city. I think that the Eurozone is over-rated as a disaster area. They are not yet in as bad shape as Britain. The UK pound," he continues, "is about to collapse. And the collapse of the British economy will be one of the biggest in modern economic history. Of course you will take the American dollar and the euro down with you, for sure. But this place – London – is about to go belly up. It's … how can I put this?" Keiser pauses. "If you see me walking the streets of your town," he adds, "then you're probably fucked."