http://www.counterpunch.org/2011/11/15/ ... ized/printThis copy is for your personal, non-commercial use only.

November 15, 2011

A Short History of Elite Responses To Political-Economic Crisis

How The Oligarchy Gets Politicizedby ALAN NASSER

The performance of the US economy from the mid-1970s to the present was no match for its relatively robust performance during what economists call the Golden Age – 1949 to 1973. This was in fact the longest period of sustained growth in US history, when most (white) working people had achieved a degree of material security unknown earlier and unattainable since. But from the late 1960s and through the 1970s economic malaise was increasingly in evidence, signaling worse to come: high rates of both inflation and unemployment -stagflation- was not supposed to be possible in a Keynesian (1) world, but there they were, and seemingly intractable. At the same time workers’ productivity declined dramatically. Profit rates fell steadily for more than ten years as revived Japanese and European economic competitors increasingly ate into US manufacturing’s share of both world trade and the domestic market itself.

Corporate and political elites responded with the cold bath treatment. “The standard of living of the average American,” pronounced Fed chairman Paul Volcker on Oct. 17, 1979, “has to decline. I don’t think you can escape that.” Interest rates went through the roof. Austerity was the order of the day, and it still is.

In 1983 an analysis of US decline and the ensuing rise of Thatcher-Reaganism appeared, in the book Beyond the Waste Land, by three Harvard-based radical economists - Sam Bowles, David M. Gordon and Thomas Weisskopf. The book received favorable reviews in many mainstream media, including The New York Times and The New York Review of Books. Reviewers included the distinguished US economists John Kenneth Galbraith, James Tobin and Kenneth Arrow.

The authors argued that a social-political factor of great importance figured crucially in the decline of US hegemony: workers had become more secure and therefore more emboldened by Keynesian New-Deal benefits like Social Security and unemployment insurance, and the labor-friendly social programs of Lyndon Johnson’s Great Society. Labor’s uppityness was especially striking in the 1960s and early 1970s. There was a notable increase in labor actions, from strikes to industrial sabotage. With fewer workers worried about where the next mouthful would come from, we saw an increase in goofing off on the job, tardiness, job-switching, pressure for improved workplace safety measures and demands for higher wages and benefits. The result was a decline in productivity (output per unit of labor input) and a wage-push profit squeeze.

Most importantly, the legacy of the New Deal and the Great Society had resulted in a shift in the distribution of national income from capital to labor.

Bowles, Gordon and Weisskopf argued that with effective unions and unprecedented security, labor had achieved a degree of power over capital hitherto unknown. This analysis has been developed more recently by the economists Jonathan Goldstein and David Kotz, who show that every Golden-Age recession was generated by a wage-push profit squeeze in the preceding expansion. According to Bowles, Gordon and Weisskopf, capital did not take this sitting down. Corporate America initiated a counteroffensive which the authors called the Great Repression. Capital’s counterattack, we may say, persists to this day.

Liberal Thinking About the Politics of the Elite

Several of the most prominent liberal reviewers of Beyond the Waste Land were scandalized by the authors’ claim that capital deliberately organized active political resistance to working-class advances. In the New York Times (July 31, 1983) Peter Passell, who at the time wrote about economics for the Times’s editorial page, complained that the book exhibits an “emphasis on conspiracy.” John Kenneth Galbraith was far more insightful and dismissive of mainstream orthodoxy than liberals of a Paul Krugman or Robert Reich kidney. Yet he too could not imagine that the vested interests deliberately muster forces antithetical to working-class interests. In his otherwise generous praise for the book in The New York Review of Books (June 2, 1983) Galbraith registered a “serious complaint about the authors’ position on political power…. They see the present sorry behavior of the economy as the result of a thoughtful and deliberate exercise of corporate power.” Galbraith repudiated the authors’ “conviction that the present disaster is designed – that it reflects in a deliberate way the interest of the corporations. This I do not believe. I would attribute far more to adherence by the corporate world to outdated and irrelevant ideology, and to political leaders, not excluding the president, who do not know what damage they are accomplishing.”

It is as if acknowledging elites’ political activism gives credence to class analysis, which is thought to be too Marxian for our own good. Talk of corporate dominance of the State opens the door to unacceptably subversive reconceptualizations of matters we have been trained to understand in safer, less seditious terms. Seeing a recession as a strike of capital, for example, forces us to make the appropriate readjustments in a range of related economic and political understandings. Indeed, as Galbraith recognized, Beyond the Waste Land requires us to think and to act very differently regarding what political power is all about. It is less unsettling to imagine that “irrelevant ideology” and political ignorance lie at the heart of the current economic debacle, than it is to see the depression as the outcome of a deliberate assault on working people by the oligarchs.

These liberal objections are far less believable now than they were 28 years ago. Elites are not philosophers seeking to be guided by the most intellectually cogent theories. Political power is not about upholding this or that ideology; it is about legislating in this or that group’s interest. Political power is exercised most successfully by those whose interests are most consistently served by the exercise of State power.Cui bono? remains the best test of who matters most to the State managers. The latter govern; the former rule.

By this test only the blind fail to see that Wall Street is now running the show. The blind abound among liberal intellectuals. In his New York Times column on Nov. 23, 2009, Paul Krugman confesses that “It took me a while to puzzle this out. But the concerns Mr. Obama expressed become comprehensible if you suppose that he’s getting his views, directly or indirectly, from Wall Street.” You don’t say.

Krugman’s epiphany was available before Obama was elected. In September 2008, finance capital stepped forward, openly and unabashedly pushed aside its political representatives, and proceeded to dictate policy to the Congress and the White House. Hank Paulson demanded $700 billion for the banksters, with no strings attached: there would be no restrictions on how the handout was spent, no hearings, no Congressional debate, no expert testimony and Paulson was not to be held accountable. Obama suspended his campaign for a day to make phone calls urging Congressional Democrats to obey Paulson’s orders. His top economic advisors, his Treasury Secretary, his Fed chief, turned out to be mostly Wall-Street-linked deregulators. It was more than a year before it dawned on Krugman that Obama might be Charley McCarthy to Wall Street’s Edgar Bergen.

Elite Responses To Crisis

The political activism of the elite is striking in times of crisis, when the latter takes the form either of severe economic contraction or of working-class militancy, or both. Let’s look at the specifics.

The ruling class has attempted directly to address crisis situations in each of the three major economic downturn periods since 1823. I treat nineteenth century American capitalism (1823-1899) as a single depression period, since over the course of sixty years it featured three steep depressions, 1837-1843, 1873-1878 and 1893-1897. Indeed, the entire period 1823-1898, excluding the Civil War, saw the nation in recession or depression more often than not. The Great Depression of the ‘30s was of course the second such period, and the years from late 2007 to the present constitute the third.

The corporate oligarchy has also responded to the New Deal/Great Society Golden Age as another crisis period, this time of a special kind. In that case the crisis was not perceived by the elite as purely economic, but as political, involving a transfer of both income and power from the wealthiest to the rest. Ruling-class mobilization ensued. The plutocrats openly “put politics in command.” Neoliberalism began to take shape.

After a brief review of the plutocrats’ responses to the depression periods and the Golden Age, I will look more closely at the stretch of time from the mid-1970s to the end of the twentieth century as a prolonged insurgency of the vested interests against regulated and relatively-worker-friendly American capitalism, and as a buildup to the current mess.

We begin with the corporate class’s first modern historical attempt to coordinate its power as a class. This was an effort initially confined to the economic sphere. Once the elite had established a private regime of market collaboration, it became clear that subsequent threats to its interests would require political mobilization. What we face now is a ruling class politically organized as never before, and with a firm grip on State power.

The Nineteenth Century: Depression Paves The Road To Corporate Organization

Railways and steel epitomized the chronic economic instability of nineteenth-century US capitalism. In each case enterprises repeatedly competed their profits away into bankruptcy or receivership. Finance capital responded by pressuring its industrial counterpart to consolidate in order to avert the perpetuation of what was very close to three quarters of a century of sustained slump.

Keynes famously described a clear instance of irrational competition: “Two masses for the dead, two pyramids are better than one; not so two railroads from London to York.” In fact, in Britain and in the US the railroad magnates had repeatedly built two or more railways from A to B, with the predictable consequences: bankruptcies proliferated. By the end of the nineteenth century the giant railway networks were the largest business enterprises in the world, yet by 1900 half of them had gone into receivership.

The financial magnate J.P. Morgan was attuned to the contribution of fratricidal competition to recurring economic downturns and, not incidentally, to the attending threat to bank profits. He persuaded the biggest railway barons to organize. He had them form “communities of interest” to reduce destructive competition by fixing rates and/or allocating traffic between competing roads. Most of these efforts failed; invariably at least one of the companies would try to take advantage of the others’ compliance by breaking its promise.

Morgan’s response was, in retrospect, epoch-making. He implored his real-economy counterparts to consolidate as a matter of policy. Consolidation, he urged, was the most effective antidote to cutthroat-competition-induced depression and falling bank profits. Concentration was in capital’s best interests. Practicing what he preached, Morgan took control of one sixth of the nation’s largest railroads.

The steel industry exhibited a similar dynamic. The superinnovator Andrew Carnegie introduced productivity-enhancing technological improvements with uncommon frequency. His high rate of capital replacement lowered his unit costs, raised his competitors’ costs and devalorized their obsolete capital, enabling him to price-compete many of them to bankruptcy.

This left bankers like J.P. Morgan with big debtors unable to service their loans. Cutthroat competition was again rightly perceived by Morgan as contrary to the interests of capital.

Carnegie was a special nuisance to Morgan, who repeatedly implored him to slow down his innovations. When Carnegie resisted, Morgan simply bought him out and consolidated the Carnegie Steel Company with some of its weaker competitors. In 1901 Morgan’s steel behemoth became US Steel. This gave precedent and impetus to the oligopolization of major industries that was to become a hallmark of twentieth century capitalism. Cutthroat price competition was replaced with “corespective” competition, effected mainly through advertising, new products, improved technology, and organizational change.

Morgan had become the nation’s first prominent active critic of cutthroat competition. His effort consciously to limit competition was the first historical attempt of a major ruling-class activist deliberately to intervene in the dynamics of the economy in response to viral bankruptcies and depression.

Morgan’s lessons are implicitly subversive. He instructed his industrial brothers that their individual interests are best realized by action in concert. Morgan understood that the most effective agent of capitalist success is not the individual but the class. The same of course applies to anti-capitalist success. This Morgan did not discuss.

Organized capitalism was strikingly different from its nineteenth-century ancestor, with one exception. In both periods economic liberalism persisted; government regulation was almost entirely absent. The absence of regulation was a major factor in precipitating both the Great Depression and the current severe downturn.

The Great Depression: Coup d’Etat as Response to the New Deal’s Politicization of the State

J.P. Morgan’s response to crisis was to recommend to his class brothers a new form of industrial organization. The resulting reconfiguration of the private economy was accomplished with virtually no overt participation by the State, in accord with the prevailing laissez faire ideology. The notion that the State could respond to economic malfunction by active intervention had not yet entered official thinking.

During the crisis of the 1930s the dominant orthodoxy was severely challenged. Morgan’s precedent for dealing with economic collapse generated by unbridled competition was that the Big Boys could put their own house in order by teaming up. By contrast, 1930s capital was without private, class-grown strategies adequate to the task of getting the Great Depression under control.

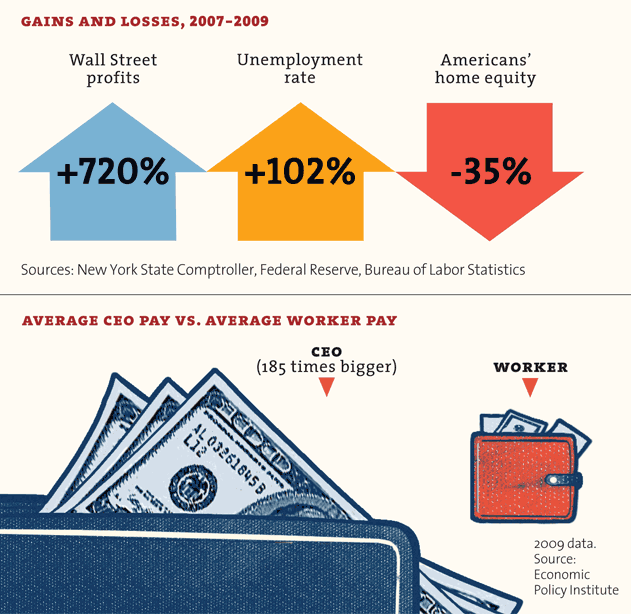

The seeds of the Depression had been planted in the 1920s, when the economic scene was strikingly similar to what precipitated the current downturn. Output, investment, productivity and profits rose much faster than wages. Unions were weak and inequality soared -1928 was the then-record year for income inequality- and working people relied heavily on debt to finance their purchase of the avalanche of newly available consumer durables. During the latter half of the decade economic growth was driven largely by credit-fueled consumption expenditures.

The unprecedented inequality that emerged from this setup widened the gap between productive capacity and effective demand and caused, beginning in 1926, a marked slowdown in the purchases of the very consumer durables -radios, refrigeratots, toasters, automobiles- on whose growth the health of the productive economy had become dependent. The growth rate of manufacturing declined dramatically, and investment-seeking capital fled to speculative financial markets, ultimately inducing the crash of 1929. Sound familiar?

Reflecting on these realities, the Keynesians surrounding Roosevelt proposed the notion that the economy had reached “maturity” during the end-stage industrialization of the 1920s. All previous expansions out of downturns had been propelled by investment spending on means of production and workplaces; the nation was still industrializing. This time, and for the first time, it was different. Excess capacity abounded at the end of the decade, but not, as in the nineteenth century, as a result of serial bankruptcies. The triple blights of inequality, over-investment and underconsumption were the culprits. With the basic industrial infrastructure now in place, and productive facilities glaringly superfluous, if the economy was to recover there had to be a resurrection of consumption demand. But the condition of the private economy ruled this out. This is what Keynes understood. His was a prescription for the economic restoration of a mature industrialized economy in the depths of a severe, sustained and self-perpetuating downturn.

The historical stage was now set for the birth of the Keynesian insight that only an agent outside the sphere of the market, and unmotivated by the quest for private profit, can restore a mature capitalist economy in deep depression. Many of FDR’s early “Brain Trust” were solid Keynesians, and the combination of their tutelage with mounting labor militancy convinced the president to initiate a major break with free-market precedent. He initiated a grand plan of public investment and government-provided jobs which not only brought about a reversal of the downward plunge of 1929-1933, but also generated the longest US cyclical expansion recorded up to that time, 1934-1938.

To the business class this seemed an unconscionably revolutionary turn. FDR’s fierce denunciation of the banksters even as he politicized the State in the name of working-class interests was viewed as an unparalleled and horrific development, a popular assault by the State on the power of Big Wealth. The logical response of the business class was not to attempt to reconfigure the private sector as Morgan had done, but to seek to capture the State, which it perceived as a greater threat to its dominance than the Depression itself. Morgan had attended to matters economic. But the emergence of a mature oligopolized form of economic organization required from the superordinates a distinctly political response.

The ruling elite proceeded in 1933 to organize a coup intended to topple the Roosevelt administration and replace it with a government modelled on the policies of Adolf Hitler and Benito Mussolini. (A 1934 Congressional committee determined that Prescott Bush, granddad of Dubya, was in communication with Hitler.) The plotters included some of the foremost members of the business class, many of them household names at the time. Prominent insurgents included Rockefeller, Mellon, Pew, Morgan and Dupont, as well as enterprises like Remington, Anaconda, Bethlehem and Goodyear, and the owners of Bird’s Eye, Maxwell House and Heinz. About twenty four major businessmen and Wall Street financiers planned to assemble a private army of half a million men, composed largely of unemployed veterans. These troops would constitute the armed force behind the coup and defeat any resistance the in-house revolution might generate.

The revolutionaries chose Medal of Honor recipient and Marine Major General Smedley Butler to organize its armed forces. Butler was appalled by the plot and spilled the beans to journalists and to Congress. FDR nipped the thing in the bud.

The attempted coup was a landmark event in US history, baring the soul of America’s standing wealth. (We find no mention of this event in US history textbooks. History unfit to print.) We have no reason to think that these fascist instincts have been expunged from the class character of our rulers. No less important, the scandal alerts us to the elite’s Leninism, its identification of the State as the political prize of prizes, the seat of class power.

Ironically, it was Keynes who put the deliberate capture of the State on postWar capital’s agenda. 1930s Keynesianism saw the State legislating in the interests of working people, and successfully competing in the labor market with private companies. This was an explicitly politicized State functioning, in the eyes of the elite, as the executive committee of the working class.

Big capital learned a lesson of abiding importance: determining State power must be their deliberate and overriding political agenda. Siezing State power by force of arms, they had learned, is easier planned than accomplished. The final years of the Golden Age saw the captains of wealth devising a longer-term political strategy to roll back the New Deal and Great Society, and to set in place arrangements that would preclude their recurrence. This time it was to be a New Deal for capital, a State unabashedly politicized for the class that counts. These were the early formative years of neoliberalism.

The Golden Age Not So Golden For Capital

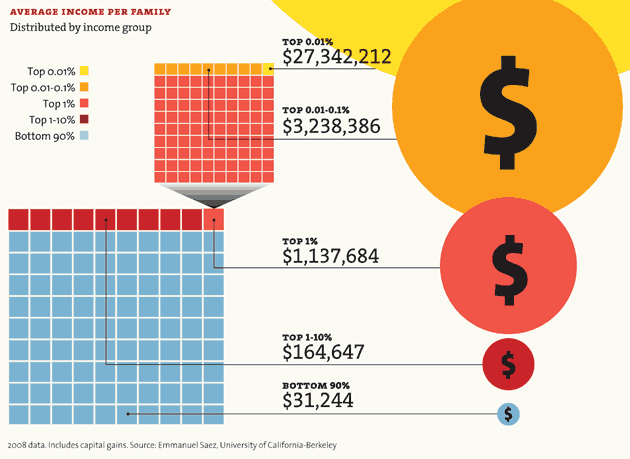

The Golden Age is distinguished by its remarkable growth rate and the unprecedented material security enjoyed by a good number of workers. But growth rates tell us nothing about how the fruits of growth are distributed. The present moment illustrates this nicely. The economy’s rate of growth has been very slow, while corporate profits and the income of the top .01% have reached record highs. Ring this up to a deliberate, policy-driven transfer of income and wealth from the rest to the richest. Distribution counts a lot for the wealthy. Their political power is a function of their wealth. If wealth and/or income is redistributed to another class, so is power. That goes down badly with rulers.

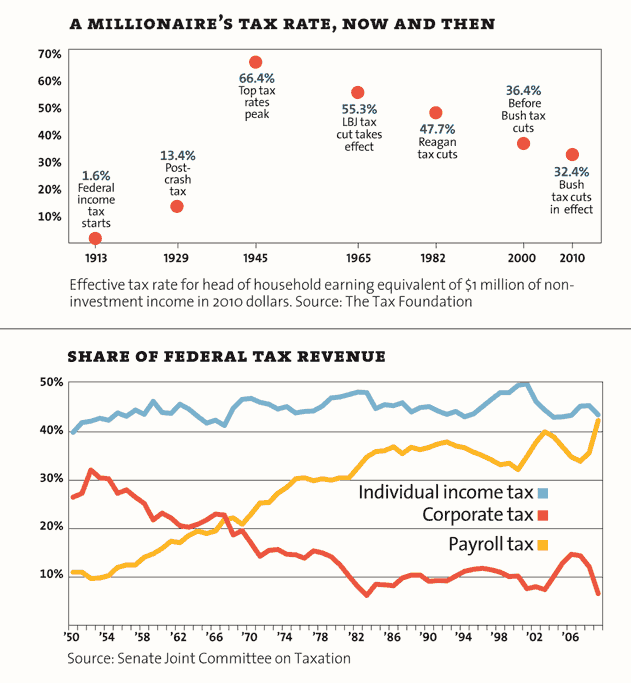

The New Deal/Great Society period saw increasing redistribution from capital to labor. The share of national income appropriated by the top 1% of households steadily declined during those years. In 1928, the most unequal year to date since 1900, the share of the top 1% stood at more than 23%; by the late 1930s it was down to 16%. It declined to 11-15% in the 1940s, to 9-11% in the 1950s and 1960s, and finally fell to its nadir of 8-9% in the 1970s.

This was the first 50-year redistribution of income from the very richest to the rest in American history. The oligarchs were to take steps to ensure that this would never happen again.

Elites saw redistribution as inherent in any State policy orientation distributing toward working people benefits which the market by itself would not produce. If you give them a little, little by little they’ll want it all. To the boys used to being in charge, Lyndon Johnson seemed to be responding to popular pressure to out-New-Deal the New Deal. The latter had given us Social Security; Johnson expanded the program to include disability payments and more. Johnson and a Democratic Congress passed new or strengthened laws, mainly around consumer and environmental issues, that cut into business profits by forcing corporations to absorb some of the costs they had previously externalized onto the rest of us.

In less than four years Congress enacted the Truth In Lending Act, the Fair Packaging and Labeling Act, the National Traffic and Motor Vehicle Safety Act, the National Gas Pipeline Safety Act, the Federal Hazardous Substances Act, the Flammable Fabrics Act, the federal Meat Inspection Act and the Child Protection Act. Whew.

Business-government relations had never before seen such an avalanche of legislation limiting the freedom of capital in the interests of working people.

Between 1964 and 1968 Congress passed 226 of 252 worker-friendly bills into law. Federal funds transferred to the poor increased from $9.9 billion in 1960 to $30 billion in 1968. One million workers received job training from these bills and 2 million children were enrolled in pre-school Head Start programs by 1968.

What made all this especially unnerving in the eyes of Big Wealth was that even the Republicans seemed to have swallowed the redistributionist line. Richard Nixon announced in 1971 “I am now a Keynesian in economics” (not “We are all Keynesians now”, as the remark is usually misquoted). Nixon was in fact a bigger domestic non-military spender than Johnson. During his first term in office Congress enacted a major tax reform bill, the Environmental Protection Agency along with four major environmental laws, the Occupational Safety and Health Administration and the Consumer Products Safety Commission.

The combination of regulation and redistribution left the working class as materially secure as it had ever been, and more inclined to feel its oats. When the economy began to approach full employment, toward the peak of a Golden-Age expansion, workers’ slacking off, tardiness, job switching and general militancy increased. The US topped the OECD’s table in strikes per worker in 1954, 1955, 1959, 1960, 1967 and 1970.

This did not go unnoticed by business. Commenting on the causes of the 1970-1971 recession following the long expansion of the 1960s, a front-page Wall Street Journal article (January 26, 1972) noted that:

‘Many manufacturing executives have openly complained in recent years that too much control had passed from management to labor. With sales lagging and competition mounting, they feel safer in attempting to restore what they call “balance”.’

It’s hard to overestimate the impact of new regulations, redistribution and labor militancy on business. Regulations are a class thing, and we shall see how they inspired the regulated to respond in self-defense as a class. We might begin by contrasting neoliberal anti-Keynesianism with the standard postwar efforts of business to influence government.

To the extent that business sought to mobilize before neoliberalism, its tactics were fragmented and limited in scope. The airline industry would lobby the Civil Aeronautics Board and/or bribe a favorite senator (e.g. Washington state’s Scoop Jackson, the “Senator from Boeing”), steel companies would lean on Congress for protectionist legislation, energy producers got tax breaks from their congressional favorite, and firms would target trade organizations. Much of this was done through personal contacts. Individual firms and specific industries had their own strategies; there was no cross-sectoral means of resistance to threats to business as a whole. But it is the nature of regulations to pose just such threats by affecting many industries at once. It is no surprise, then, that business should respond with a call for a new form of class mobilization, an all-business attempt to secure State power by political means less dramatic, though no less effective, than an out-and-out coup.

The Counterrevolt of Capital: The Legacy of the Powell Memo

Toward the end of the nineteenth century Morgan had urged industrial capital to organize itself within the private sector. During the Great Depression big capital galvanized its energies politically, in a coup attempt to sieze State power. The next major effort by business to coordinate and mobilize itself was also a political action, again aimed at control of the State apparatus, but this time with a strategy of methodical long-term class warfare.

In 1971 future Supreme Court justice Lewis Powell distributed among business circles a memo intended to politicize the captains of industry in resistance to the legacy of the New Deal and Great Society. The memo reads like a neoliberal instruction booklet:

“[the]American economic system is under broad attack. Business must learn the lesson…that political power is necessary; that such power must be assiduously cultivated; and that when necessary, it must be used aggressively and with determination – without embarrassment and without the reluctance which has been so characteristic of American business…. Strength lies in organization, in careful long-range planning and implementation, in consistency of action over an indefinite period of years, in the scale of financing available only through joint effort, and in the political power available only through united action and national organizations.”

In their remarkable book Winner-Take-All Politics, political scientists Jacob Hacker and Paul Pierson describe the organizational counterattack of business as “a domestic version of Shock and Awe.” The accomplishments are impressive:

“The number of corporations with public affairs offices in Washington grew from 100 in 1968 to to over 500 in 1978. In 1971, only 175 firms had registered lobbyists in Washington, but by 1982, nearly 2,500 did. The number of corporate PACs increased from under 300 in 1976 to over 1,200 by the middle of 1980. On every dimension of corporate political activity, the numbers reveal a dramatic rapid mobilization of business resources in the mid-1970s.”

This period also saw the birth of militant mega-organizations representing both big and small business. In 1972 the Business Roundtable was formed, its membership restricted to top corporate CEOs. By 1977 the Roundtable’s membership included the CEOs of 113 of the top Fortune 200 companies. The chairman of both the Roundtable and Exxon in the early Reagan years, Clifton Garvin remarked “The Roundtable tries to work with whichever political party is in power… as a group the Roundtable works with every administration to the degree they let us.”

The Conference Board further sharpened capital’s political focus by gathering leading executive especially well positioned to personally contact key legislators. The Board developed an ingenious agenda: to learn the tactics of public interest groups and organized labor in order to subvert the agenda of those very groups.

The Roundtable and the Board lobbied and established ongoing relationships with Congressional staffs. Organizations representing smaller firms also grew rapidly in the 1970s. With higher unit costs and no oligopoly pricing power to offset the administrative costs of regulation, these firms were highly motivated to mobilize. The Chamber of Commerce and the National Federation of Independent Businesses doubled their membership, with the now very effective Chamber tripling its budget.

It was during this period that the corporate presence on the Hill became conspicuously ubiquitous. While business had always been disproportionately represented in DC, never before had the chambers of legislation seen such thoroughgoing corporatization.

Corporate strategy was not merely a matter of bribing top politicos. The biggest organizations had learned their lessons well from their antagonists, the public interest groups pressing the popular demand for regulation, and organized labor. The business counterrevolt mimicked the strategies of those groups. Corporate groups used their ample resources, including sophisticated marketing and communications techniques, to organize mass campaigns composed of a heterogenous grouping of shareholders, local companies, employees and mutually dependent firms like retailers and suppliers. Washington would be deluged with phone calls, petitions and letters pushing business interests.

In short order elites surpassed both public-service organizations and organized labor in what they had done best, bottom-up organizing.

Within ten years the corporate takeover was well established. In the 1980s corporate PACs shelled out five times as much money to congressional campaigners as they had put out in the 1970s.

The agenda of the political infrastructure of rallied capital was to undo those policies and State priorities which had generated the redistribution and labor activism limiting the freedom of capital and enhancing the power of workers for almost three decades. In sum, the legacy of the New Deal and Great Society had to be undone. But these were political-economic projects which required ongoing bolstering by the State if they were to be kept effective. Mobilized capital had to capture the State and render it inoperative for proletarian purposes. The State had to be as explicitly reconstituted as a capitalists’ State as the elite perceived it to have been hitherto rigged for workers and against the Big Boys. This required the functional equivalent of a coup.

And a coup there was. Simon Johnson, former chief economist of the International Monetary Fund, wrote in one of the nation’s major weeklies of the “the reemergence of an American financial oligarchy” in “The Quiet Coup”, The Atlantic (May 2009). Johnson made it clear that his use of “coup” was not intended as a rhetorical flourish or a metaphor. Finance capital had effectively privatized the State. Neoliberalism had succeeded not merely in guaranteeing permanently reactionary governments, it had captured the State itself. Previously, a change in government -e.g. from the Eisenhower to the Kennedy administration- might mean a significant change in domestic policy within the context of an abiding Keynesian State. Neoliberalism has sought to change the fundamental priorities of the State.

Mission Accomplished: The Privatized Neoliberal State

All of the major developed capitalist countries have deindustrialized over the past thirty years. The industrial capacity of the West is overripe, and widget production has accounted for a declining share of total output, total employment and total profits in these once-democracies. FIRE’s shares have correspondingly risen, and its top dogs now rule the roost and call the global shots. This has gone hand in hand with a string of financial crises. (2) This setup requires much more, not less, State implication in economic life.

To bail out or not to bail out – and who is to be rescued at whose expense? How is manufacturing to thrive in the current climate of intensified competition among deindustrialized developed countries, with the emerging markets poised to enter the fray? The present answers to these questions are clear. The financial elite get everything while manufacturing is “restructured” as a low wage sector targeting the world’s fastest growing markets, which are not to be found in the imperial metropoles. Unemployment rates are to be kept high until the wage level drops low enough to render the US an effective competitor in global markets. None of this could begin to get off the ground without massive State collusion with corporate interests. The financial bailout and Obama’s restructuring of the auto industry are but the most conspicuous of many examples. The new State is to become -has become?- a capitalist State not in the trivial sense of the State of a capitalist country, but as a State unambiguously by and for Big Wealth.

Putting the Class Character of the State on the Political Agenda

The government is not the same as the State. The governmental alternatives -Republican or Democrat- within the context of an anti-Keynesian neoliberal State must be so limited as to count as no alternatives at all. That there is not a dime’s worth of difference between the Parties is what we should expect, given the dismantling of the State’s postwar social functions. If the remnants of the New Deal and Great Society are regarded by the State managers as “the old time religion”, as Obama characterized them in The Audacity of Hope, then the policy alternatives must be, from the perspective of working-class interests, piddling, and the pseudo-squabbles between the Parties inconsequential.

The historical unfolding of American capitalism has put the class character of the State squarely on the political agenda. It has been the plutocracy’s top priority for a long time. It is clearer to more Americans than ever that the entire political establishment is unprepared and unwilling to manage the economy and the State in the interests of working people. The ruling-class concerns of the neoliberal State homogenizes policy options and renders standard Party politics otiose and obsolete. An effective Left political program must make available to its constituency a radically revised conception of what it means to do politics. No less important is the forging of a political practice which compellingly incarnates that radical reconception. An independent OWS is just what such a practice would look like in its embryonic stages. Very much hinges on how that movement develops.

Notes.

(1) References to Keynesian policy require the reminder that Keynes encouraged economic policy far more radical than what the New Deal and Great Society offered. Perhaps the most neglected Keynesian prescription is his insistence that fiscal policy and government employment are not tools confined to recessions. Keynes held that full employment required ongoing targeted government stimulus, even during cyclical upturns.

(2) Savings and loans (early 1980s), Mexican debt crisis (1982), Mexican peso crash (1994, one year after the passage of NAFTA), Asian Financial Crisis (1997), Russian devaluation and default (1998), Argentina’s eebt crisis (2001), Enron (2001), Worldcom (2002), the hi-tech, dot.com bubbles of the late 1990s and the present turmoil, unparalleled of its kind in the history of capitalism.

Alan Nasser is Professor Emeritus of Political Economy at The Evergreen State College in Olympia, Washington. This article is adapted from his book in progress, The “New Normal”: Chronic Austerity and the Decline of Democracy. He can be reached at

nassera@evergreen.edu