Moderators: Elvis, DrVolin, Jeff

"....since quantitative easing is not something that occurs without limitation or attention to circumstance, but rather something that occurs only in a deflationary environment when it's the only option available,..."

"..An injection of money into the pockets of consumers would actually be good for the economy, but QE3 won’t do it. The Fed could give production and employment a bigger boost by using its lender-of-last-resort status in more direct ways than the current version of QE.

It could make the very-low-interest loans given to banks available to state and municipal governments, or to students, or to homeowners. It could rip up the $1.7 trillion in government securities that it already holds, lowering the national debt by that amount (as suggested a year ago by Ron Paul). Or it could buy up a trillion dollars’ worth of securitized student debt and rip those securities up. These moves might require some tweaking of the Federal Reserve Act, but Congress has done it before to serve the banks.

Another possibility would be the sort of “quantitative easing” first proposed by Ben Bernanke in 2002, before he was chairman of the Fed—just drop hundred dollar bills from helicopters. (This is roughly similar to the Social Credit solution proposed by C. H. Douglas in the 1920s.) As Martin Hutchinson observed in Money Morning:

With a U.S. population of 310 million, $31 billion per month, dropped from helicopters, would have given every American man, woman and child an extra crisp new $100 bill per month.

Yes, it would produce an extra $31 billion per month on the nominal Federal budget deficit, but the Fed would have printed the new bills, so there would have been no additional strain on the nation’s finances.

It would be much better than a new social program, because there would have been no bureaucracy involved, just bill printing and helicopter fuel.

The money would nearly all have been spent, increasing consumption by perhaps $300 billion annually, creating perhaps 3 million jobs, and reducing unemployment by almost 2%.

None of these moves would drive the economy into hyperinflation. According to the Fed’s figures, as of July 2010, the money supply was actually $4 trillion LESS than it was in 2008. That means that as of that date, $4 trillion more needed to be pumped into the money supply just to get the economy back to where it was before the banking crisis hit.

As the psychological boost from QE3 wears off and the “fiscal cliff” looms, perhaps Congress and the Fed will consider some of these more direct approaches to relieving the economy’s intractable doldrums."

bluenoseclaret wrote:There must be a limit to this bubble.

bluenoseclaret wrote:"....since quantitative easing is not something that occurs without limitation or attention to circumstance, but rather something that occurs only in a deflationary environment when it's the only option available,..."

I am sceptical of the effects of "Q.E" has on the real ecomomy .

I feel it just pours into a financial/derivative black hole.

Why not do the following instead:

Some Possibilities That Might Be More Effective at Stimulating the Economy"..An injection of money into the pockets of consumers would actually be good for the economy, but QE3 won’t do it. The Fed could give production and employment a bigger boost by using its lender-of-last-resort status in more direct ways than the current version of QE.

It could make the very-low-interest loans given to banks available to state and municipal governments, or to students, or to homeowners. It could rip up the $1.7 trillion in government securities that it already holds, lowering the national debt by that amount (as suggested a year ago by Ron Paul). Or it could buy up a trillion dollars’ worth of securitized student debt and rip those securities up. These moves might require some tweaking of the Federal Reserve Act, but Congress has done it before to serve the banks.

Another possibility would be the sort of “quantitative easing” first proposed by Ben Bernanke in 2002, before he was chairman of the Fed—just drop hundred dollar bills from helicopters. (This is roughly similar to the Social Credit solution proposed by C. H. Douglas in the 1920s.) As Martin Hutchinson observed in Money Morning:

With a U.S. population of 310 million, $31 billion per month, dropped from helicopters, would have given every American man, woman and child an extra crisp new $100 bill per month.

Yes, it would produce an extra $31 billion per month on the nominal Federal budget deficit, but the Fed would have printed the new bills, so there would have been no additional strain on the nation’s finances.

It would be much better than a new social program, because there would have been no bureaucracy involved, just bill printing and helicopter fuel.

The money would nearly all have been spent, increasing consumption by perhaps $300 billion annually, creating perhaps 3 million jobs, and reducing unemployment by almost 2%

None of these moves would drive the economy into hyperinflation.

According to the Fed’s figures, as of July 2010, the money supply was actually $4 trillion LESS than it was in 2008. That means that as of that date, $4 trillion more needed to be pumped into the money supply just to get the economy back to where it was before the banking crisis hit.

As the psychological boost from QE3 wears off and the “fiscal cliff” looms, perhaps Congress and the Fed will consider some of these more direct approaches to relieving the economy’s intractable doldrums."

bluenoseclaret wrote:I believe it was Max Keiser who said that there was record high bond prices in the UK. There must be a limit to this bubble.

Kro

bluenoseclaret wrote:

The money would nearly all have been spent, increasing consumption by perhaps $300 billion annually, creating perhaps 3 million jobs, and reducing unemployment by almost 2%

Wombaticus Rex wrote:bluenoseclaret wrote:There must be a limit to this bubble.

Probably not. My dad thought the same thing in the 70's.

"On June 30, QE2 ended with a whimper. The Fed's second round of "quantitative easing" involved $600 billion created with a computer keystroke for the purchase of long-term government bonds. But the government never actually got the money, which went straight into the reserve accounts of banks, where it still sits today. Worse, it went into the reserve accounts of foreign banks, on which the Federal Reserve is now paying 0.25-percent interest.

Before QE2 there was QE1, in which the Fed bought $1.25 trillion in mortgage-backed securities from the banks. This money, too, remains in bank reserve accounts collecting interest and dust. The Fed reports that the accumulated excess reserves of depository institutions now total nearly $1.6 trillion....."........

.....As for "quantitative easing," if the intent is to stimulate the economy, the money needs to go directly into the purchase of goods and services, stimulating "demand." If it goes onto the balance sheets of banks, it may stop there or go into speculation rather than local lending -- as is happening now....."

Suppose the new money created since 2009, instead of propping up bond prices, had simply been added to the bank accounts of all U.S. and British households. In the U.S., $2 trillion of QE could have financed a cash windfall of $6,500 for every man, woman and child, or $26,000 for a family of four. Britain’s QE of £375 billion is worth £6,000 per head or £24,000 per family. Even if only half the new money created were distributed in this way, these sums would be easily large enough to transform economic conditions, whether the people receiving these windfalls decided to spend them on extra consumption or save them and reduce debts......."

.""....U.S. households’ real estate assets are still languishing at $16 trillion, down sharply from $23 trillion in 2007 – however, the Fed’s quantitative easing programs have helped households’ stock market wealth bounce back to $21 trillion, close to an all-time high.

Importantly, the movement in stock prices relative to house prices is an excellent gauge of wealth polarization, and hence the relative strength of top-end versus mainstream consumer spending.....

"...Economist Anthony Randazzo of the Reason Foundation wrote that QE “is fundamentally a regressive redistribution program that has been boosting wealth for those already engaged in the financial sector or those who already own homes, but passing little along to the rest of the economy. It is a primary driver of income inequality.”...."

But QE3 will have no more effect on job creation, housing, or general economic recovery than has its predecessor QEs. QE is not about boosting jobs, housing, or the real economy. QEs are about subsidizing investors and boosting stock, bond, derivatives, and commodity futures markets and therefore the capital incomes and returns of investors, both individual and corporate.............

....The significance of the Fed’s QE3 move therefore is there will continue to be free money in unlimited amounts to banks and investors to hoard or to speculate and play with, while it’s cuts in spending and disposable income for the rest of us...."

"..Paul Krugman says that QE, expansive monetary policy and inflation help the little guy (the 99%) and hurt the big banks (the 1%).

Of course, followers of the Austrian school of economics dispute this argument – and say that it is only the big boys who benefit from easy money.

As hedge fund manager Mark Spitznagel argues in the Wall Street Journal, in an article entitled “How the Fed Favors The 1%”:......

"The Fed is transferring immense wealth from the middle class to the most affluent, from the least privileged to the most privileged. This coercive redistribution has been a far more egregious source of disparity than the president’s presumption of tax unfairness …."

"... and why government bonds are 'peaking' and gold is about to explode - as the safe-haven 'tie' between the two is about to be smashed apart..."

"....In the 2012 edition of Occupy Money released last week, Professor Margrit Kennedy writes that a stunning 35% to 40% of everything we buy goes to interest. This interest goes to bankers, financiers, and bondholders, who take a 35% to 40% cut of our GDP. That helps explain how wealth is systematically transferred from Main Street to Wall Street. The rich get progressively richer at the expense of the poor, not just because of “Wall Street greed” but because of the inexorable mathematics of our private banking system............"

Its microeconomic effects were negligible, apart from the people-not-finding-themselves-living-in-a-collapsed-insolvent-world thing that I mentioned.

And high inflation, maybe hyper.

bluenoseclaret wrote:You appear prone to a touch of exagerration., I would appreciate any evidence for such a sweeping statement.

alimmouse wrote:QE has kept more people in their homes? Id love to see some evidence of that C2W.

Sure

bluenoseclaret wrote:Evening C2W

I state..."You appear prone to a touch of exagerration., I would appreciate any evidence for such a sweeping statement."Sure

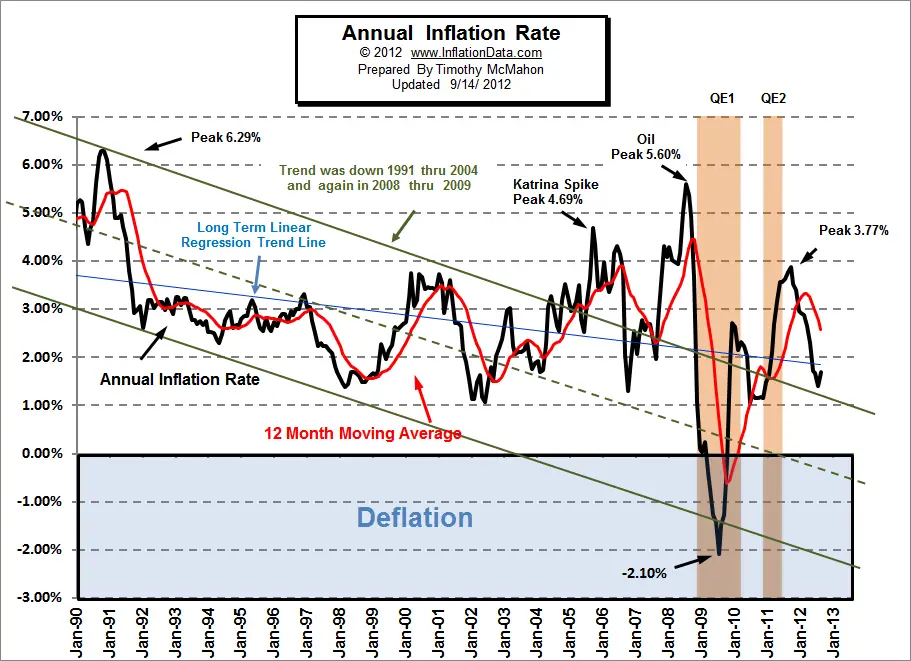

You reply witha graph about inflation. Would you care to explain?

Thanks about the secondary market, I will look into it.

Don't forget there is always a better way of doing things. ( Whether Right/Left ..who cares....."Regulatory Capture"..with regard to government comes to mind)

Political Economy, most definitely should be scutinised..

Kro

c2w? wrote:

Because they're really only equivocally effective at doing what they're supposed to do for the same reason that QE does not provide direct relief to anybody but banks: The United States just doesn't do direct public aid, most of the time. Refuses to do it. That's a very longstanding problem. It's perpetuated by plutocrats in and/or funding both parties, but primarily and more absolutely so by the right. They get away with it by scarifying the public about debt and taxes. And that's been true in really almost exactly the same way for almost a century, with a little occasional fluctuation here or there.

bluenoseclaret wrote:Evening C2W

I state..."You appear prone to a touch of exagerration., I would appreciate any evidence for such a sweeping statement."Sure

You reply witha graph about inflation. Would you care to explain?

Users browsing this forum: No registered users and 16 guests